Throwing on some more extremely rough math:

Assume the average person lives 80 years.

Assume they start working at 20, and retire at 65.

Average out $4.4 mil over 45 years for an average yearly income their entire working life of…

$97,777.77

Ok, now check that against this:

https://www.omnicalculator.com/finance/us-income-percentile

And you get 83rd percentile, alternately stated as you have to be in the top 17% of Americans, by income.

Now again this is quite rough and the most obvious challenge to this math is that these estimated costs seem more to be for households, not individuals.

Well, ok, then if you go by household total income if $97k, this is the 65th percentile of households, ie, top 35% of households.

But to that one can counter that divorce rates are still climbing, and according to BLS, only about half of married households have both partners working.

https://www.bls.gov/news.release/famee.nr0.htm

… So basically the American Dream™ only exists for something around a quarter-ish of Americans, and of course half of that quarter would basically be considered quite wealthy.

Removed by mod

I get what you’re going for here but doing the actual numbers is quite complicated.

A hospital visit every 10 years… I’m assuming you mean something that is both ruinously costly in just literal healthcare costs, and then may also prevent you from working.

This is a realistic thing to take into account, but I don’t know how to even bullshit estimate averages involved.

Could add lifetime costs of tens of thousands… to millions.

For student loans, maybe you can bullshit a 20 year repayment plan on $75k with 7% interest as a ballpark figure for all those with student loans, even though a bachelor degree is less costly than a phd.

That adds about $200k in lifetime costs for an individual.

…

But none of this can get at the other problems of … ok so you got your degree, but you can’t actually find a relevant job in the field that pays well, or a disaster wipes you out, or your student loan payment keeps you from being able to afford a reliable car or live anywhere near the jobs are…

…and the nature of career trajectories is that you have to have no setbacks to get to that high income at the end of your working life to pull up the average to account for your lower starting wages.

Its all compounding. The luckier you are early on, the less you have to do later on. Unlucky early on? You’re basically fucked and will never escape the poverty trap.

That’s more of an income or class mobility question, and well that situation is getting worse and worse as well. For an increasing amount of people, the costs of being poor (financial, medical, mental, crime victimization likelihood, etc) make it more likely to fall off an upward trajectory, or just never get on one to begin with…

…AND most employers will do literally anything they can to avoid actually raising your wage, they’ll list bullshit ghost job openings that are entirely fake or are actually just going to be internal hires, or have utterly absurd experience requirements.

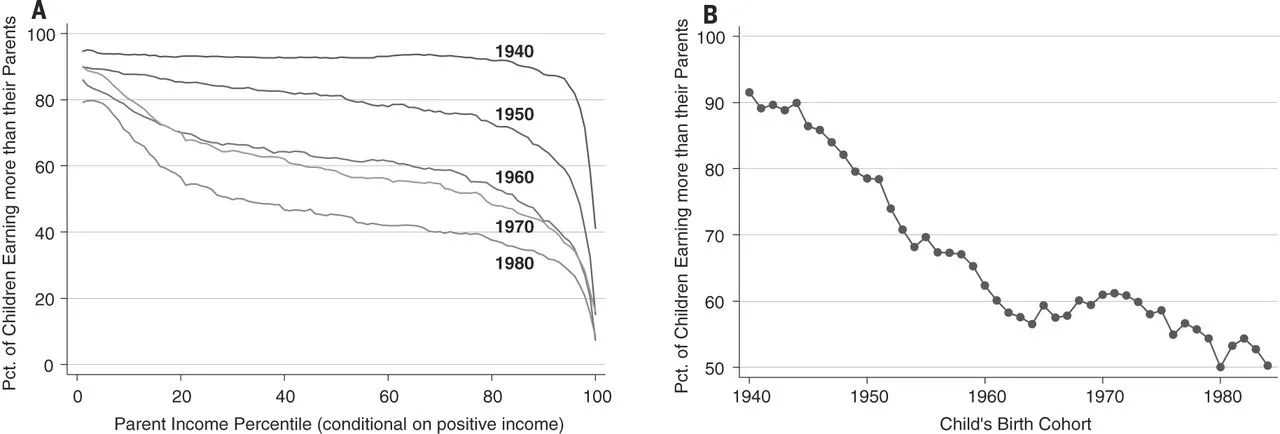

Empirically measuring lifetime income mobility can really only take place when a generation is near the end of that generation’s working life, but there is a strong connection between current income inequality and future degradation of income mobility.

https://www.science.org/doi/10.1126/science.aal4617

Bullshit, napkin math style extrapolation of this trend would put the % of kids that earn more than their parents at roughly 20% to 30% by 2020.

Basically, we live in an ossified class system society: Only about a quarter of people can currently afford to live the material ‘American Dream’ of owning a home, having a family, decent job, new car… and only a quarter can realistically live the apsirational ‘American Dream’ of simply doing better than your parents.

…And its just going to get worse, barring a bevy of reforms and government programs which seem utterly politically impossible with roughly half (more?) the country still earnestly believing we live in a meritocracy when we very, very obviously do not.

Visiting your doctor every ten years feels wild to me. I go at least a couple of times a year, mostly due to minor things but it’s always reassuring to have a check.

Removed by mod

Due to your comment I have been checking the costs of different interventions and treatments in the US and while I thought it was bad I didn’t think it was outright life ending.

and if you account for taxation it’ll be even less

“The lifetime tab for such aspirations as owning a home, driving new cars, raising kids and taking annual vacations comes to a cool $4.4 million, according to Investopedia, the financial media site. "

I wonder how much of it is interest through bad financial decisions. They don’t really push starting investments early or how to avoid the trap. But a lot of this could be down to people being conned with aspirational lifestyles at 25% APR. You shouldn’t be able to just go a buy a brand-new car, but now it’s needed for the industry to function, and people do it before having anything else sorted.

Vacations are another one we’ve been convinced we simply have to go to all these places 2 or 3 times a year. Most of us haven’t explored our own doorsteps yet.

Weddings that figure is crazy and people get the pressure to go further than that. As a married person, trust me, no one cares. They’re there for you, not some crazy venue. They all had to travel 4 hours to get to.

No doubt the cost of living has gotten well out of hand and earnings to interest rates are disgusting. But instead of making ladders, we make comfort blankets and focus on the previous generations and trying to play the game their way. The game is to beat inflation and most of us are on hard mode but it can be done.

Not if you skimp by, differing needed care. You can all live to a not-so-healthy 35 this way. Shut them eyes again and get to countin’ sheep!

If everybody on the planet lived like the most mediocre and most privileged pale skins in USA, the planet would be dead in a week.

Racist