From faster approvals to hiring more workers, governments need to step up: experts

Peter Armstrong · CBC News

Don’t need to build as many houses if you remove the speculators buying them out and renting them out for a premium, Building more home right now will disproportionately help realtors, and speculators more than anyone.

Vacancy is pretty much zero across the major Canadian cities. We have the lowest housing per capita in the G7. There is objectively not enough housing in Canada and it’s absolutely delusional to say otherwise. Is this wishful thinking just a form of NIMBYism? Do you own a SFH and you want to “preserve the character” of your neighbourhood or something?

Where are you getting that building more homes will disproportionately help realtors and speculators? Even non-market housing, like co-ops and social housing? How in the world does that even work?? Why would speculators like that? I hate speculators, but your theory makes no sense whatsoever!

There is not a single urban economist, right or left, who agrees with you. With beliefs like this so widespread, it’s no wonder we don’t enact any policies to actually help with the housing crisis.

The point is that landlords and speculators drive up costs - period. If you want to ease the housing crisis you could in theory build you’re way out of it. You could also bale water out of a boat while it’s sinking. Now what if you plug the hole while bailing out the water?

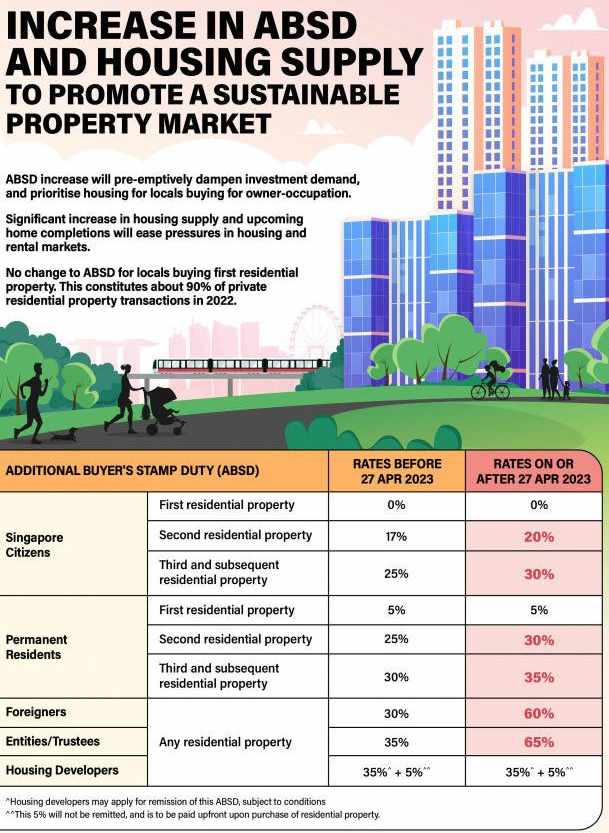

Speculators are the fucking hole. Want a second home? Cool. Make them pay 20%+ tax on it a la Singapore:

I am in support of any measures to make the lives of speculators and investors miserable but even the graphic you share endorses increasing housing supply! Singapore is famously super YIMBY and builds tons of public and market housing.

Frankly, whatever else we do, there is NO solution without significantly more supply. Yes, let’s change our tax code to stamp out speculation, but it will take years, if not decades, to catch up on building enough supply even if we make changes now.

Of course. Purely based on numbers we need more units. But again, if we build more it’s going to help speculators more than FTHB unless you over build. So you’re just growing the wealth divide.

There are already tax discounts on primary residence, there’s a capital gains exemption. Doesn’t matter because housing prices still go up too much. And why do they keep going up? Hmm… maybe something about a shortage of housing?

Speculators can’t single handedly increase the price because they still need someone to buy or rent the property for a worthwhile price.

There are areas where housing prices stagnate and it’s not like some speculators can just go in there and force prices to go up.

Not sure what point you are trying to make? What does capital gains exemption have to do with anything? If anything we should follow the US and only exempt a base amount.

I’m saying use taxes to disincentivize speculation.

There’s a reason the market became detached from fundamentals when rates were lowered. I’m not saying we don’t need to build more. Of course we do. But I’d rather not build homes that go to more investors than FTHB like is currently happening. Otherwise the situation only gets better if you over build.

Also yes, it only takes a small number of speculators to create unaffordable housing. Real estate is a market based on benchmarks. You should look into the history of the BC market and how a small number of speculators drove that market bananas.

Yes you do. Population growth went up. Housing starts went down. That’s what created the shortage that speculators are capitalizing on.

Do people hoard food when there isn’t a food shortage? And if they do, is it even a problem?

The shortage is what gives the profiteers and gougers their power.

The goal of building enough homes to have an OVER supply (a la Japan) is virtually impossible in the next two decades. So why not deal with the fact that speculators now outnumber first time home buyers and make them pay a huge flat tax beyond a primary residence?

The idea that we’ll simply build out way out of a crisis 10+ years in the making while importing millions more people at the same time is laughable. It’s also going deepen the wealth divide even more.

This is part of the problem, like AirBnB, but it’s not a 3,500,000 unit problem.

Also, no realtors involved on new builds.

They are involved in assignment sales a lot of the time though.

Given that speculators and now a larger segment of the market than FTHB, I think making a 3,500,000 unit problem a 2,.000,000 unit problem, while also driving down rents is a huge fucking win.

30% of Canadians are speculators. The leader of the official opposition at the federal level is a speculator. Tax the fuck out of speculators, minimum 25% and/or ban them.

This. Fuck. Them.

- Density

- Density

- Density

That’s idea one in the article…

Removed by mod

That is absolutely not true. Tokyo famously has some of the most affordable real estate of any major world city. You can buy a spacious detached home in the Tokyo area for less than in Hamilton, ON. Despite the stereotype, Japanese homes are bigger than the average in most European countries.

Montreal has had the most affordable housing of the big Canadian cities. Why? Because they have the least land restricted to single family homes. Check out this zoning map. Even now, Montreal has three times the housing starts of Vancouver.

The reason why we build shoeboxes is because we preserve single family home zoning. Super high density towers, or super low density suburbs, the two most expensive forms of housing with nothing in between. To tackle affordability, we need missing middle housing. And I totally disagree about using up space: suburban sprawl sucks. I want to live in charming medium density!

Here is an alternative Piped link(s):

Piped is a privacy-respecting open-source alternative frontend to YouTube.

I’m open-source, check me out at GitHub.

Removed by mod

I honestly don’t know where you’re getting your information from. Homes in Tokyo are famously very affordable, and units are bigger than in comparable cities like New York or Paris. This is very well known in the urban planning community, so it goes to show you’re new at this topic and making things up.

Montreal has had a growing population for years. The Francophonie is huge and Montreal is a popular destination. Your anti-French bigotry is showing. Last time they had a speculation bubble in the early 2000s, they quickly built more affordable medium density supply and the bubble receded.

Removed by mod

Talking to someone like you, who is “doing their own research” is infuriating and pointless. It is impossible to convince someone who just rejects mainstream research and misinterprets information “on their own”.

Your personal research on this topic is wrong. House prices shot up everywhere in the world due to the pandemic, but less in Tokyo than elsewhere. Population went down in cities everywhere in the world due to the pandemic and WFH, so acting like this is some trend of decreasing population in Tokyo is just deeply ignorant. New York, San Francisco, Toronto, Vancouver, all had a decrease in population due to the pandemic.

affordable doesn’t mean “cheaper” it means “cheaper as a percentage of income”

I’m not sure what point you’re trying to make. That is precisely how Tokyo is more affordable than Canada. Housing prices are WAY less than half of New York. It’s truly remarkable that you think New York is more affordable than Tokyo!

I also lived in Japan and speak the language fluently, and I met a lot of people like you who barely spoke the language and came back home acting like experts. Here is a $1.18 million USD home in Meguro city. It is over 2300 square feet! Garage, terrace, three large bedrooms, and way more nearby amenities than most Canadian cities. Also, this is freaking Tokyo! Comparing it to Hamilton is ridiculous. And yet, it’s still more affordable!

Affordable housing doesn’t exist for one simple reason, there are too many owners who benefit from using their housing as an investment.

And not ever because there is not enough housing?? After WW2, Canada built tons of new homes for returning vets. Are you saying housing would have been JUST AS affordable if we didn’t? That’s such a ridiculous idea, I don’t know how someone could believe it. Yes, make it hard to treat housing as an investment, but we also need people like you to stop obstructing supply.

Removed by mod

You could make your way through Montreal without ever speaking French.

Why are we listening to a Ana Bailao? She was part of the government that dropped this particular ball. Why don’t we ask Mike Harris what to do about water treatment, or Kathleen Wynne what to do about power generation?

So zoning, workers, and financing:

“I always look at it in three buckets: You need the approvals, you need the people to build these things and you need a way to finance it,” said Ana Bailão

Workers:

Economists have long argued that the federal government needs to adjust its immigration targets to bring in more electricians and plumbers.

Financing:

“[The CMHC program called ] RCFI no longer works because the interest rates are too high,” Keesmaat said. "The government could very quickly act to lower the rate of borrowing through RCFI for new construction projects."She says that would tip some development projects back into viability.

This is the best summary I could come up with:

The federal government’s decision to eliminate the GST on purpose-built rentals is expected to add tens of thousands of units to the housing market.

Prime Minister Justin Trudeau this week announced the move to waive the federal portion of the HST on the construction of rental housing.

Mike Moffatt, senior director of policy and innovation at the Smart Prosperity Institute in Ottawa, is still trying to figure out precisely how the elimination of the tax will impact supply.

“When I talked to developers in my capacity as a minister of immigration before today, one of the chief obstacles to completing the projects that they want to get done is having access to the labour force to build the houses that they need,” he said.

Economists have long argued that the federal government needs to adjust its immigration targets to bring in more electricians and plumbers.

The key, Bailão says, is making that pressure stick, so the elimination of the GST is just the beginning of broader changes to address the crisis in a meaningful way.

The original article contains 1,004 words, the summary contains 173 words. Saved 83%. I’m a bot and I’m open source!