As a seperate point to the bellow, since this is something you constantly say it must happen, how do you ever expect the Yuan to take a substancial share of the dollar’s position worldwide without any QE happening and without some financial carrots thrown to foreign finance capital. Its impossible. Any dedollarization wordwide has to come with an increased yuan share even if it never becomes more than a moderate minority % wise. Every single measure taken would have to be taken sometime for that to happen.

But either way not everything has to be about the dollar.

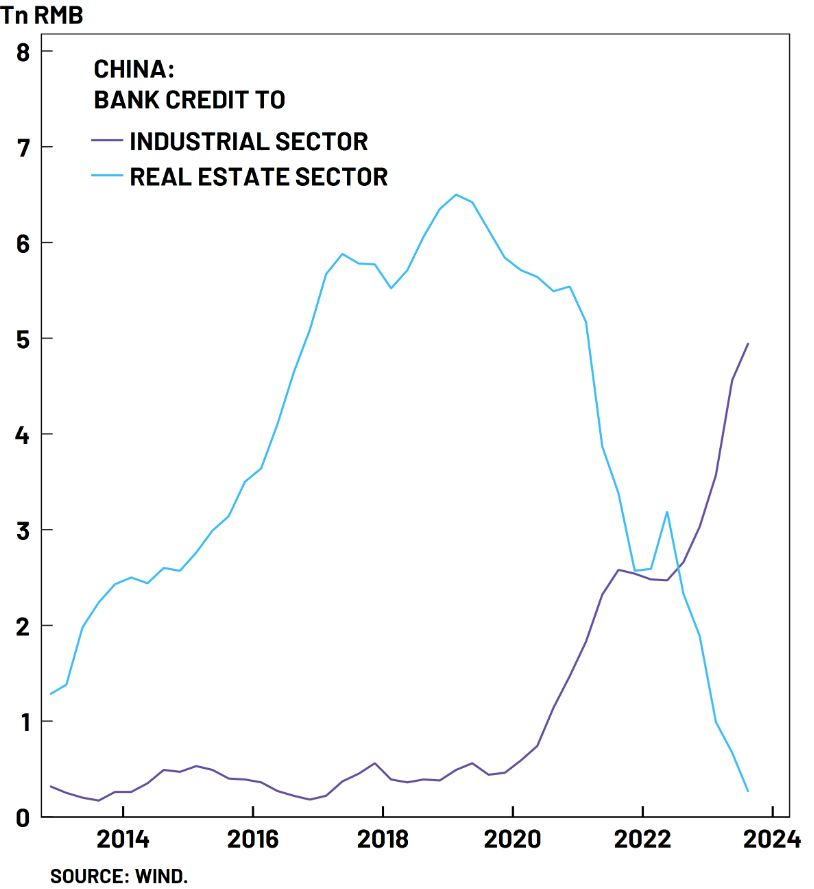

What the central govt just did is that they spent a year letting the financial system languish in an all downside environment, making the financial sector so desperate for any kind of dependable asset to invest in that investors started begging for sovereign bonds at any yield, which then effectively lowered the cost of issuing more sovereign debt, and reset market wide ROI expectations from the lofty days of real estate exuberance, ultimately making it cheaper to start the transition from a land finance based financial system to sovereign bonds finance. The central govt had the option of intervening much earlier to preserve a higher anchoring point for long term financial value extraction, and instead they chose to wait for the credit cycle to bottom until it was clearly starting to impact economic momentum before intervening with fresh credit injections. They saw 3 straight months of deceleration and decided to do some easing. Decisions on intervention have followed quarterly trends for years now. They will a continue drip irrigation approach until they feel there is sufficient headway on debt deleveraging.

And some other notes

The fiscal element is smaller than the chinese pandemic stimulus and much, much smaller than the '08 chinese stimulus. If we factor incremental credit, the size difference is even larger.

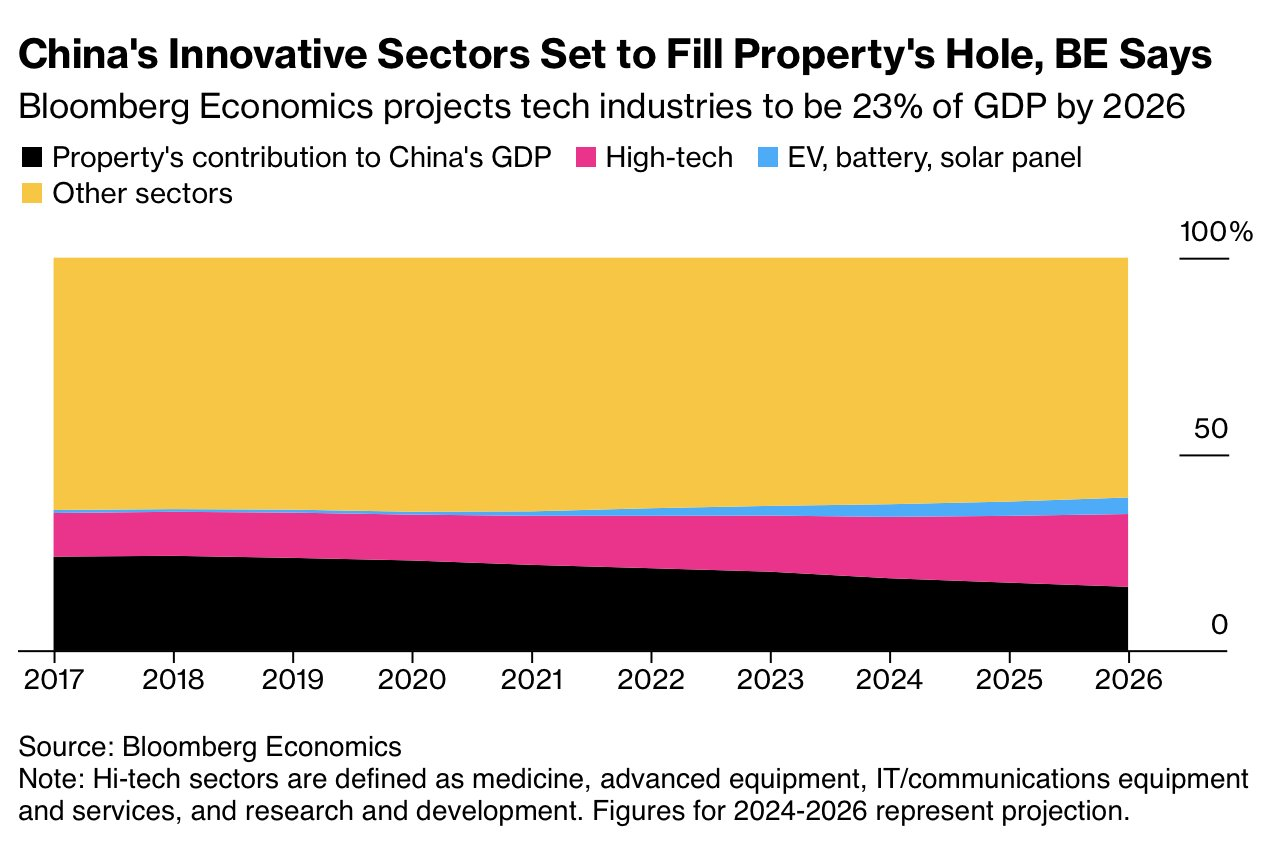

Capital formation is what drives credit formation in China. GCF as a % of GDP rose in the 2000s, plateaued over the last decade and is presently transitioning to its decline phase. The aim of loosening credit is to stabilize capital intensity i.e. prevent it from declining too quickly. Beijing is very focused on the downward slope of the transition. Also Higher-income groups drive the majority of demand (consumption and gross capital formation) in China in the last decade. So even tho CPC focus is on decreasing inequality and uplifcting lower income groups (GINI has droped like a rock in the last decade after all) into a healthy consuming middle class they still have to make sure the economic activity of higher income groups doesnt drop too much and too fast before the lower income groups ,well stop being that, and are able and willing to support domestic consumption on their backs. But RE downturn and stock market being garbage has made lot of the top 10% in China lose and decrease their treats a bit too fast for CPCs liking so throwing some stock numberinos and helping measures is meant to stabilize that decline into something managable , not to reverse the trend or the economic restructuring. So for example the mortgage interest cuts impacted ~50 million households that have mortgages, totaling approximately ~150 million people, or ~9-10% of the total population. These households are predominantly in the top two quintiles but acounted for an outsided piece of the total consumption and GCF like i said and like i said their economic activity was dropping a bit too fast for China’s liking

So when economic indicators weakened in the summer, much of it driven by worsening sentiment — especially in higher-income groups. Beijing’s worry was on trickle-down effects from higher-income groups to the broader economy. For example, Fixed Asset Investment growth in the larger, higher-income provinces was faltering. It was down ~3% in Guangdong YTD. That is important for lower-income migrant workers in the largely blue-collar construction and manufacturing industries. On the consumer side, declining/stagnant asset prices clearly contribute to such worsening sentiment and decreased spending in those higher-income groups. It was enough of a real economy impact that Beijing finally felt the exercise a “call option” and try to put a “floor” on asset prices, both in its property & stock markets.

You are right. Thats why no nuclear submarines are made in fucking Wuhan and the facilities there arent even equipped for that. If that changed somehow you would see massive and visible constructions and renovations there for the last 1-2 years. Only conventional submarines are made there. Nuclear chinese subs are made near the coast as well and the facilities there have no issue with capacity. China sudenly deciding to make nuclear subs 5k km upstream where the river has an average dpeth of less than 10 meters (a depth that even mini nuclear subs would be fully visible by satellite if submerged) for no reason ridiculous.

Also if you look into the reporting this is literally the same debunked story from months ago that goten new life just cause they asked some random us officials and showed them the picture and he said “yeah thats plausible” .Thats the official confirmation talked about in the reporting