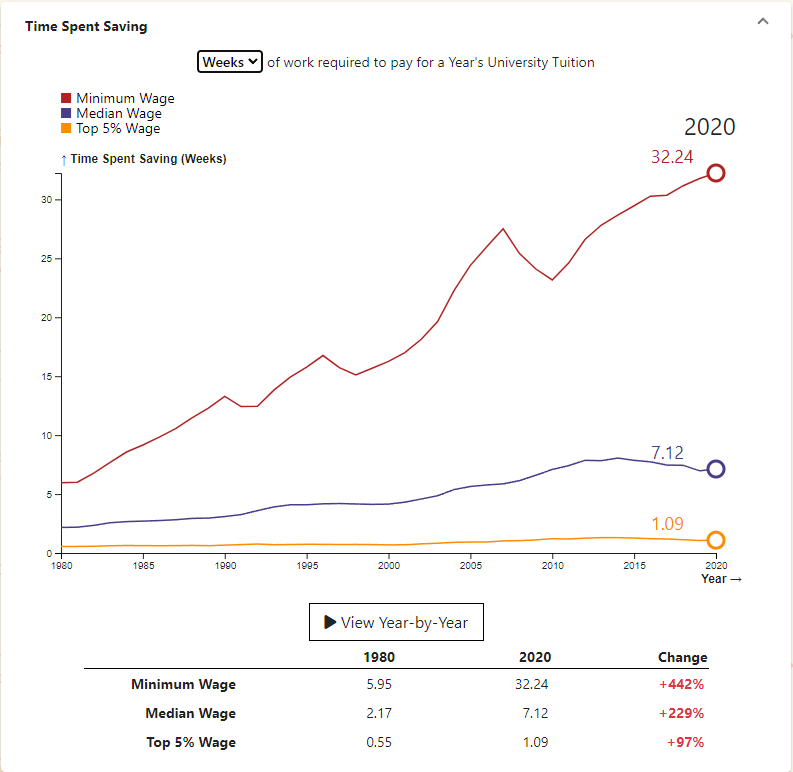

Workers have to work for a longer period of time in order to afford University Tuition than they used to in 1980. The trend is hardest on minimum wage workers who have to work 32.24 weeks of full-time work in 2020 to afford tuition, compared to 5.95 weeks of full-time work in 1980. This ignores taxes and assumes all money earned is put toward tuition.

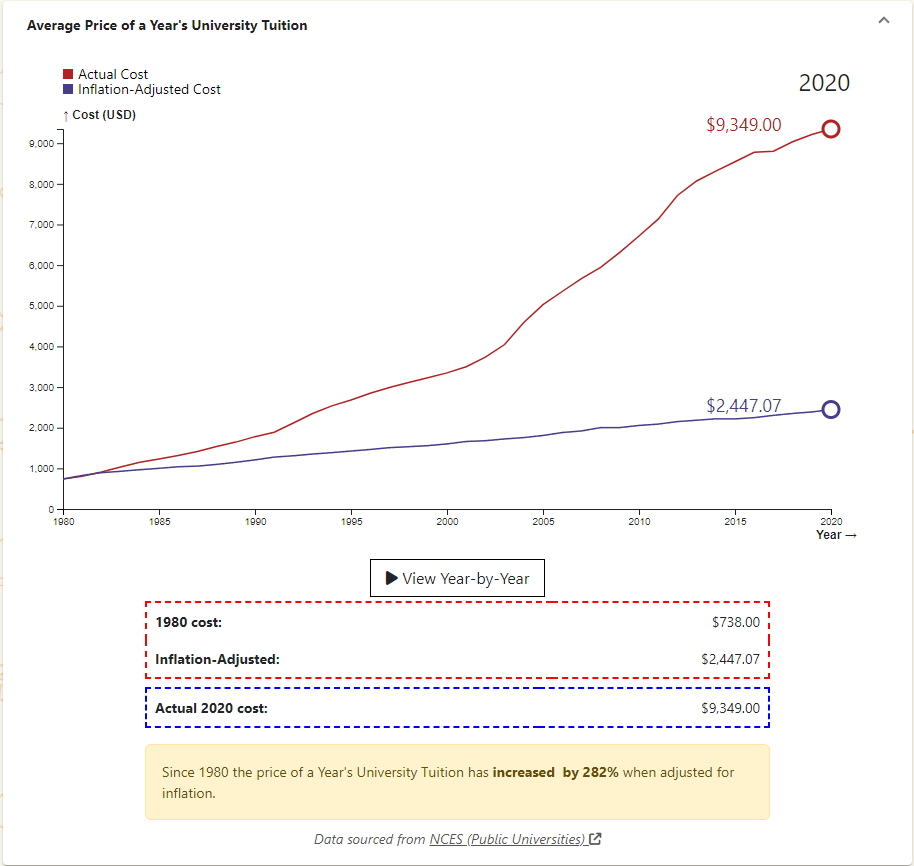

Since 1980 the price of a Year’s University Tuition has increased by 282% when adjusted for inflation.

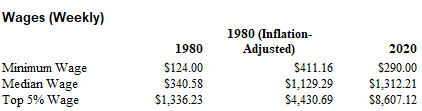

Wages have gone up nominally, but not as much when accounting for inflation. The minimum wage has decreased since 1980 after adjusting for inflation.

Sources:

- Median and Top 5% Income: Census.gov (Table H-3)

- Minimum Wage: Department of Labor

- Year’s University Tuition: NCES (Public Universities)

Visualized on boomerchecker.com

Edit:

- Fixed an error when converting Median and Top 5% from annual to weekly. The time to save for those two brackets rose as a result.

- Added wage data for the different wage brackets for reference.

How much work does it take to label your axis?

Updated for humor - but in all seriousness good data visualization on how out of reach college is becoming for an increasing amount of people. Your accounting for all wages being absolute take home also drives home the fact that the # of weeks required is going to be much much higher.

Honestly that really puts into perspective how cheap it is lol.

How much did it cost your parents to put you in high school? That’s how much university costs in other developed countries. There is no reason that the US can’t afford 4 more years of school for you. We aren’t magically broke after your senior year of HS.

I wouldn’t say that’s the case. Remember that this is for one year. For many careers, you need four years minimum. Then this also doesn’t seem to account for additional costs of living like food and housing you would need while saving.

Yeah and college SHOULD be an investment. We have 8 year car loans, it taking 8 years to pay off 4 years of college wouldn’t be bad. I say this as someone about to go in my junior year of college but I work at a crappy factory which pays for tuition for me after each semester, which is extremely common. And costs of food and housing are separate to tuition, which I’d all the schools are in control of. Also, my food and housing is 95% of my income. If you don’t work for four years then you taking 8 years to pay it off isn’t horrible. The issue is charging interest on a federally backed loan. The government should force these loans to be not for profit.

I’m confused. In the 5% bracket, a $16k tuition: this comes out to like a 900k/year job…is that where the top 5% is?

I added the wage data for each bracket to the OP for reference. I did have an error where I was dividing the Median and Top 5% annual wages by 40 instead of 52 to get the weekly wage. I fixed that and updated the OP. The average wage for the Top 5% in 2020 is $447,570 annually or $8,607 weekly, so for $16k tuition it would take 1.86 weeks of saving for a Top 5% earner. However the average tuition is $9349, so it would only take 1.09 weeks for a Top 5% earner to save that much.

This data is sad