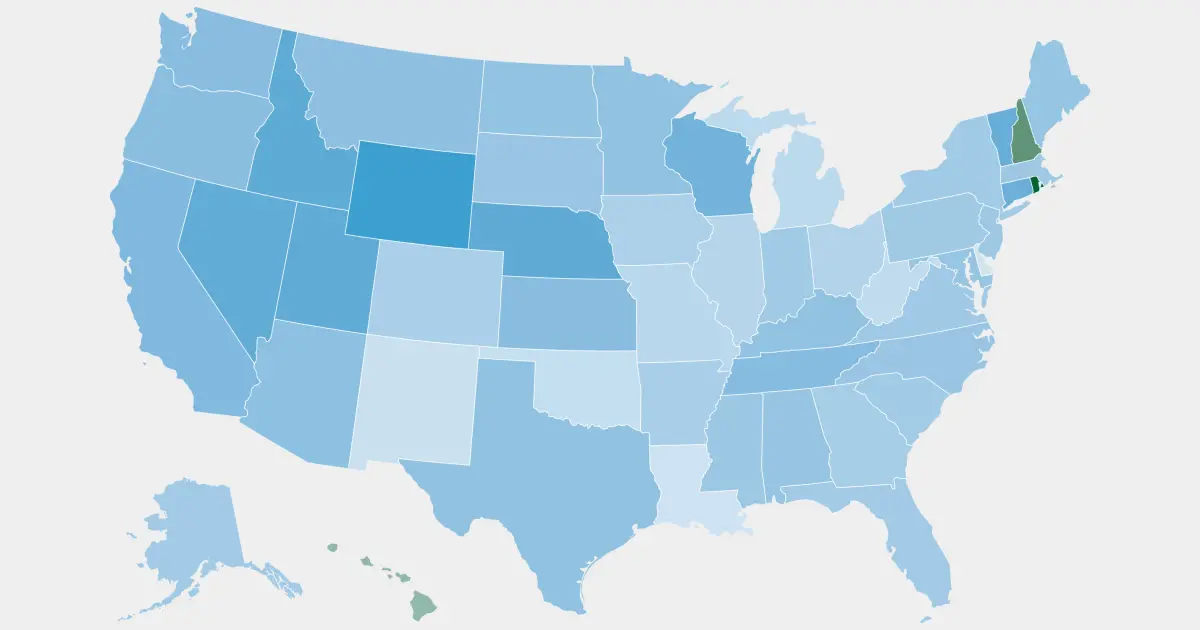

One in 4 middle-income new homeowners — twice as many as a decade before — are buying into cost-burdened situations.

The share of middle-class Americans who are buying wallet-squeezing homes has more than doubled in the previous 10 years.

Almost 30% of middle-class homeowners bought homes with monthly payments costing more than 30% of their income in 2022, an NBC News analysis of Census Bureau data found. That’s more than twice the share from 2013, with experts warning it leaves many households with less money for groceries and emergencies and less able to get ahead in the future.

That “cost-burdened” benchmark — in which a household devotes over 30% of income to housing costs — is a widely used measure of affordability for both homeownership and renting. The Census Bureau measures housing costs against it, and the Department of Housing and Urban Development has used it for decades.

$2100 a month for insurance? That might be more than my whole house payment. Paid pretty much nothing down on 175k in very late 2018 - house is apparently worth 350k now, but we’re trapped because I can’t/won’t afford to move. I’m 85 miles from the office, but I WFH and it looks like I might have to go in about once a year.Well that’s what I get for not wearing my glasses…

I read it as 2100 all in, tax and insurance.

Lol no prob. I’ve always paid my taxes/insurance through my loan account so I do not think of them as separate expenses

I do not make 240k/year and it’s looking like I’ll have to pay $2400/month for all 3.

I should’ve known just based on the insanity of that rate, but I think there are places in Florida that are that much or even more, so I guess that’s where my head was.