- cross-posted to:

- [email protected]

- [email protected]

- cross-posted to:

- [email protected]

- [email protected]

With fast-growing private equity firms controlling as much as 20% of the U.S. economy with minimal disclosure requirements, business leaders must understand the implications of increasing concentration of ownership by both private equity firms and index funds and advocate for enhanced reporting standards, a Harvard Law School professor argues. At stake: market competitiveness, innovation, and economic fairness.

…

Private equity has its origins in leveraged buyouts in the 1970s and 1980s. The idea was to take companies, usually publicly listed on the stock exchange, borrow a lot of money—that’s the leverage—and buy them out. Then, they could use their control to improve the value of the company and resell it, typically 3 to 5 years later. That’s the original idea of what private equity mostly does.

What’s changed since then is that the scale of operations of private equity has grown and grown and grown—to the point that now private equity controls between 15% and 20% of the entire U.S. economy. They’re no longer buying isolated companies and flipping them back to the public markets. Instead, they buy them and sell them to mostly other private equity firms. They’ve become their own separate capital universe.

…

The private equity industry is very good at convincing Congress or regulatory officials to shape laws in a way that allows them to remain essentially dark. They don’t put out public reports. They don’t put out any information that the public can use to evaluate what they’re doing, or even their investment performance.

It is increasingly a challenge for the legitimacy of capitalism. Capitalism depends upon some degree of transparency about how it’s functioning, how workers are being treated, and how consumers are being treated.

Capitalism depends upon some degree of transparency about how it’s functioning, how workers are being treated, and how consumers are being treated.

What ideology is this?

Wishful thinking

This is the kernel of idealism. You say shit like “Capitalism depends on some degree of transparency,” or “As virtue is necessary in a republic, and in a monarchy honor, so fear is necessary in a despotic government,” and just keep repeating it until the world rearranges itself to reflect your haughty aphorisms (this never happens).

Mainstream neoliberalism.

The Democratic Party

It doesn’t say it relies on them being treated well

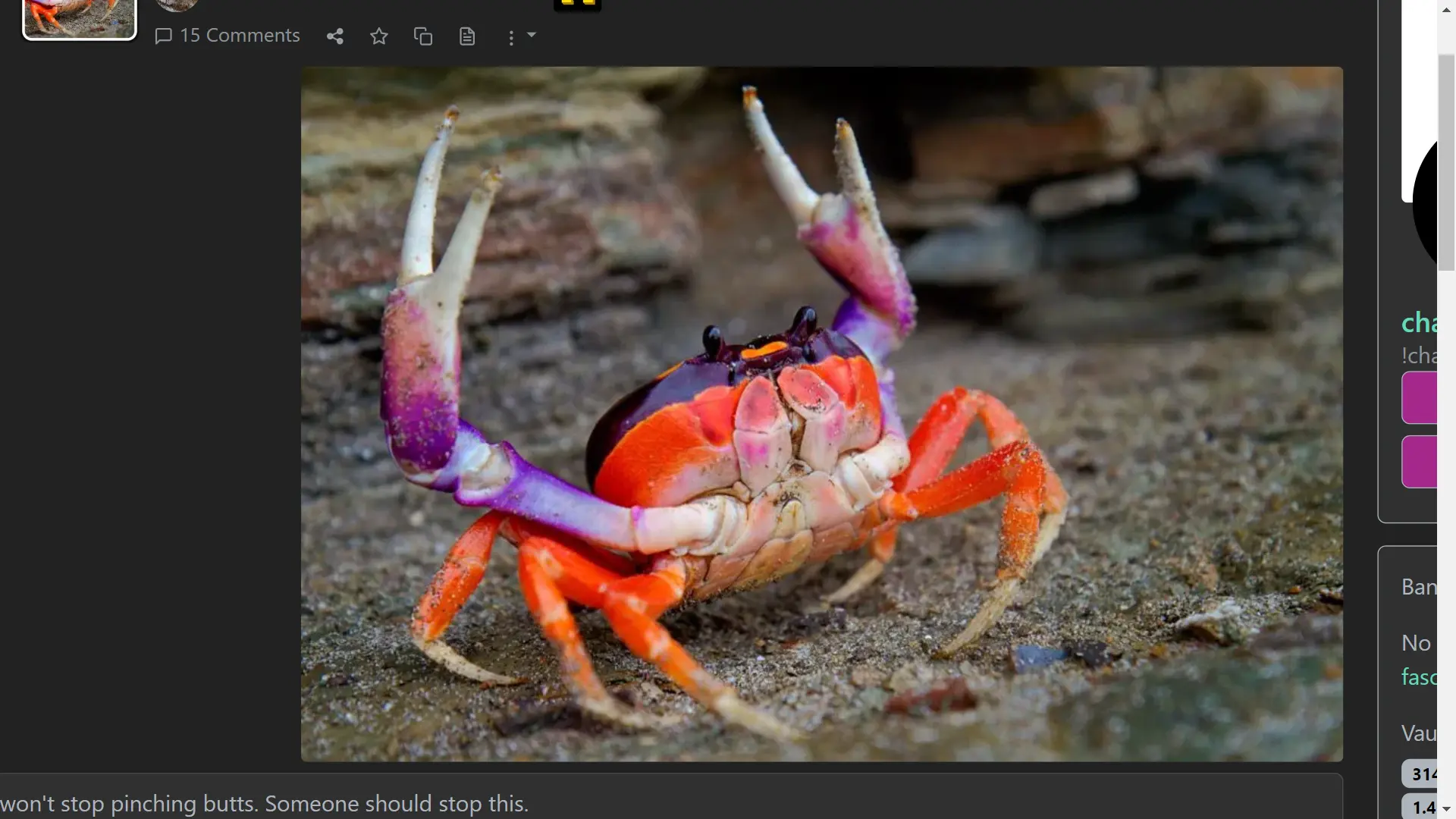

This really fucking sucks

PE is projected to own something like 40% of single family homes by 2030 and it’s beginning to show

be sure to VOTE even harder next time!

Oh your senator is the new Kristen Sinema? Oh well, better vote harder next time!

It is entirely a coincidence that when Dems are about to have a heckin majority, someone always switches parties! No one could have predicted this

If you really want to own a home, have you simply considered not spending all your money on rent so you can save for 10 years and buy a small condo?

Capitalism depends upon

If it’s not exploitation and violence then it’s cope

some degree of transparency about how it’s functioning, how workers are being treated, and how consumers are being treated.

rolls eyes

PE in the healthcare sector is really something. Truly vampiric behavior.

It just reflects the literal vampirism they do when they take blood plasma from the poors

Do you think private equity is allowed to acquire real estate in hell?

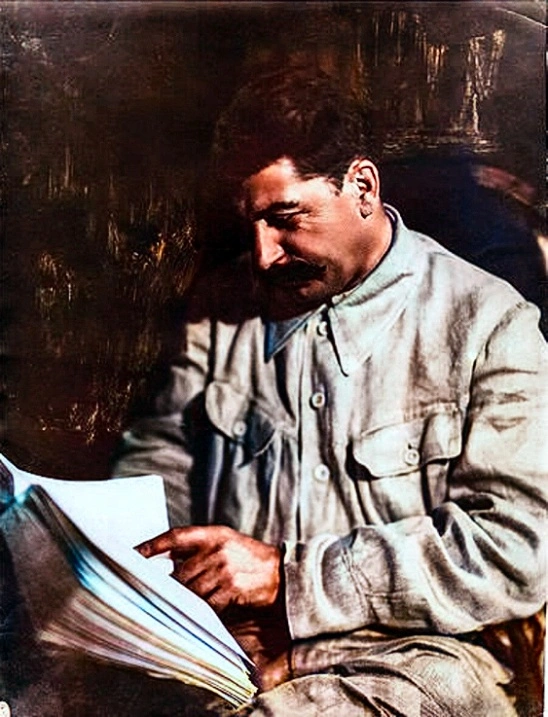

If Lenin was here, he would call it finance capital (bank + industry capital), a good component of imperialism

Srsly tho, this sounds like one of the concentration of capital talking points he made

Finance capitalism is also called monopoly capitalism for a reason

That’s fine right? I’m sure that’s not a big deal

deleted by creator