ciferecaNinjo

- 102 Posts

- 255 Comments

2·5 days ago

2·5 days agoI think there is a beer festival every year in Grand Place. Is this that one or is this something new?

1·7 days ago

1·7 days agoCodified right to repair means different things in different jurisdictions. It started in some states in the U.S., where the policy is narrowly true to the title. Thus artificial hinderances to repair are prohibited there.

The EU’s policy is much broader because it comes under the green initiative. It not only gives consumers a right to repair but also creates mfr obligations to facilitate the exercise of that right. People without the skills to repair are served by a rule that ensures they can get something repaired at a reasonable price. But it doesn’t stop there… the law is also expected to give consumers the info they need to make a repair (documentation and where to buy parts [which must be reasonably priced]). If it were true that the law only intended to serve unskilled consumers who would have someone else do the work, then there would be no reason to obligate suppliers to sell parts alone at a reasonable price.

My question remains: exactly what info & docs will consumers be entitled to? I found one source mentioning user manuals, which is nearly useless. Though it was speculative. Perhaps I need to track down whatever latest version of the legal text is being worked. I’ve read many summaries over what to expect but they are all too vague on doc requirements.

I would encourage you to get in touch with Beko directly and see what help they can offer. And if you really want to find a service manual, try other websites such as www.manualslib.com or beko.co.uk, and even possibly archive.org.

One of my expectations is that when manufacturers have an obligation to provide docs, I will no longer be forced to traverse the enshitified profit-driven 3rd party distributors manuals who make you dance and go through various hoops like solving captchas, and disclosing email address. I gave up on Beko’s website. I had to enable a shit ton of nested cascading javascript just to navigate, only to find they want to impose a broken chat room. I might give it another go. Otherwise getting their Belgian address might require going through moniteur belge or something.

2·9 days ago

2·9 days agoLove that you are keeping tabs on the gradual decline of tech. Could be useful to build an enshitification timeline. We really need an observatory of garbage tech which then needs to be cross referenced with search results. Imagine if your bank came up in a search with a blurb next to it (sensible and functional in 2013, shitshow thereafter).

1·12 days ago

1·12 days agoThanks for the info! I guess I need to focus more on the opening first line.

Legal citations are often given by a date. E.g. ”the law of 10 June 2014”. Drives me nuts. This makes searching for the law extremely tedious because a search on dates return both laws originally enacted on that day as well as many other laws that were updated in small ways on that same day. Parliament is busy!

You say the first law seems complete, which was my intuition as well. But how do I know if I am looking at the original complete version, or the most current complete version with all amendments taken into account?

I did not post all links I found that refer to the date of 10 june 2014. Several were certainly just amendments. I got some big PDFs from Moniteur Belge expecting to see the full law. But it’s often just a collection of everything that happened on that day (or time period). Does Moniteur Belge ever publish the complete current law? I thought they did but I just struggle to understand what I am looking at.

1·17 days ago

1·17 days agowas finally able to reach that video. Love it! Indeed the song showcases hypocrisy which is what the collage tries to expose.

1·17 days ago

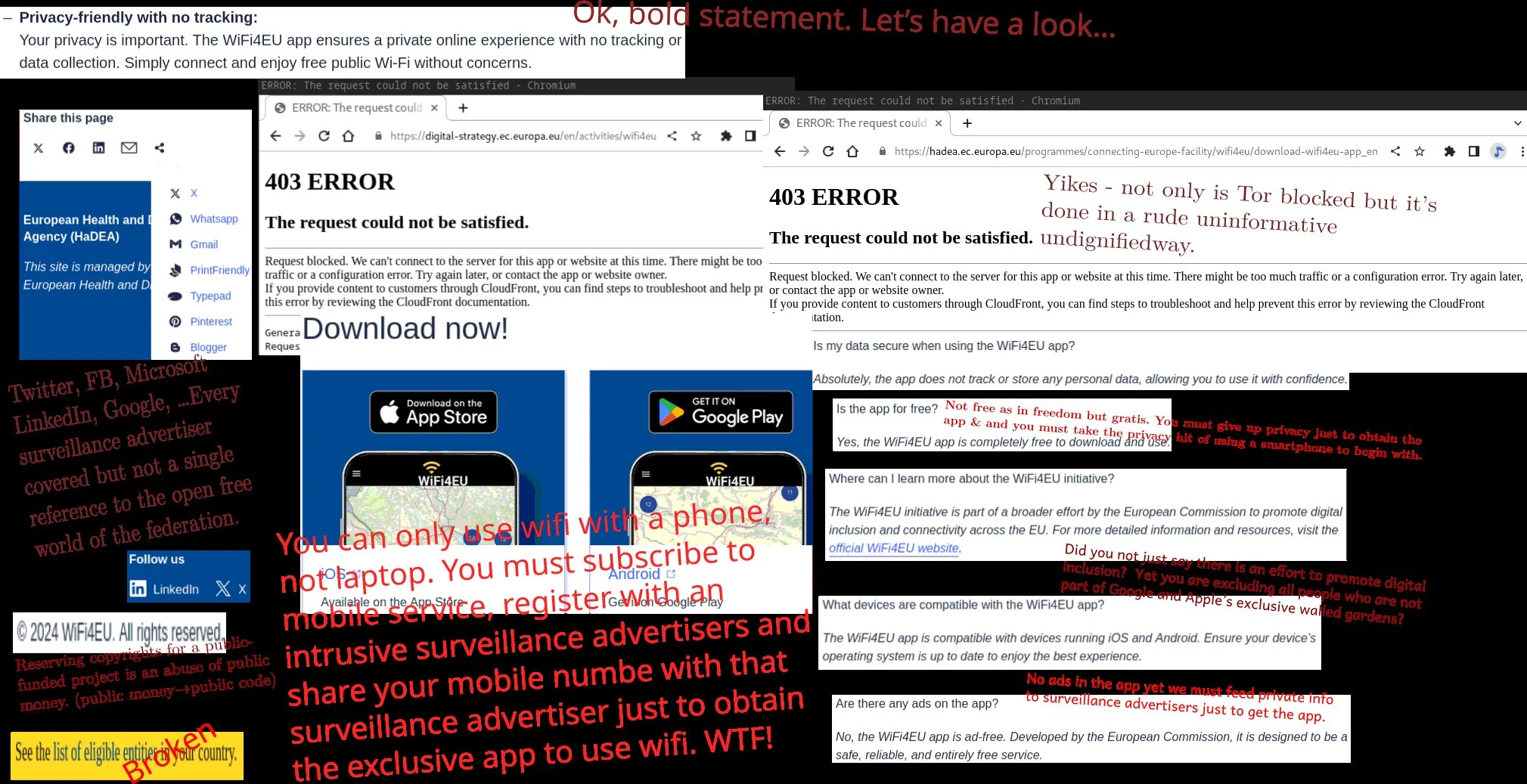

1·17 days agoI’m uncertain. The EU’s words 3 weeks ago were:

“Now, with the #WiFi4EU app, enjoy free, high-speed WiFi in public spaces across Europe.”

That seems to imply that it is. A few replies seem to suggest opposition to a smartphone app requirement:

https://freesoftwareextremist.com/objects/0f42d401-7c57-4f78-a73c-c42278ffb0ed https://piaille.fr/@aaribaud/113260758404320106 https://sns.neonka.info/@nk/113261087148349618 https://westergaard.social/objects/8d4873c1-e674-4403-9f0a-b0adb5dd4246

But this post comes from someone who apparently believes the app is purely for finding the hotspots, not using them:

https://wetdry.world/@cyrus/113264605839060934

If you find something solid let me know. I’ll correct the post if needed. The branch started by @aaribaud seems to have the most insight, implying that the EU is distrusting WPA and using an app to do TLS.

(update) I think you are right. I just heard from someone saying it’s a regular hotspot with captive portal. Still not good but not as bad as an app mandate (like we see with eduroam).

1·25 days ago

1·25 days agoBut you don’t have a human right to have it converted into cash at your leisure (and the bank’s effort) whenever you please.

When a consumer opts to close their account, the banking relationship can only be ended when the balance is zero (when neither party owes the other). You seem to be saying the UDHR does not entitle people to end the banking relationship at a time of their choosing, correct? In which case the banking relationship continues until the service fees eat away at the remaining balance, against the will of the customer. This is just another way to separate someone from their property.

Your argument is like buying gold for $20 and then complaining about human rights violations if the seller doesn’t buy it back for $20 whenever you wish.

Banking customers who open an account in the national currency have a reasonable expectation that the value of their account remain pinned to the value of the national currency. Exchanging that for a precious metal and having an expectation that value not decline would be absurd and I do not see how this analogy makes any sense.

2·26 days ago

2·26 days agoI’m with you there.

But to be clear, the website banking web access is also an app. I don’t think any banking websites function with static HTML anymore – always JavaScript required. So forced execution of non-free software had already taken hold in banking. But now it’s much worse because phone apps are more exclusive, more intrusive, and more imposing.

1·27 days ago

1·27 days agoI’ve not tested a banking app on a rooted phone but what I care about is escaping the ecocidal practice of designed obsolescence whereby people are needlessly forced to buy more new hardware to update their software. So I tried running a banking app on an Android emulator and it refused to run.

So there are 2 show-stoppers for banking apps for me:

- forced patronage of Google – no escape from Playstore (not sure if I’m okay with the Huawei store as an alternative)

- ecocidal designed obsolescence – emulators rejected

If a bank were competent enough to eliminate those two factors, I would also likely demand the app be open source.

1·27 days ago

1·27 days agoMy question was more about denominations. I do not know if cashback services allow odd amounts. Most people ask for €20.

But regarding limits, different stores have different limits. Generous stores will let you pull out as much as €150, but often the limit is €20.

1·27 days ago

1·27 days agoAh, we call that “cashback” when you use a grocery or convenient store cash register like an ATM. I did not get the impression you could ask for any arbitrary amount, but if so then that would solve that problem (case 1).

1·27 days ago

1·27 days agoOh, actually I’m not sure why I had €20 in mind. Indeed some ATMs can dispense €10. But I don’t think I’ve seen one dispense €5. Some people will miss €9.99 more than others. But regardless, it’s embarrassing that banks don’t have the competency to enable customers to cash out. They have to do a bit of a dance and a hack to get all their money out of the bank.

Can’t you exchange the money in a normal store? That at least used to be possible here.

Not sure what you mean.

1·27 days ago

1·27 days agoIf you see a value limit enshrined in the UDHR, feel free to quote it here.

3·27 days ago

3·27 days agoATMs are a particular kind of cash machine, but cash machines are not necessarily ATM machines. The machine I describe at the grocery store enables customers to pay for their groceries without the cashier having to touch the bank notes. The customer can feed a €50 banknote in the machine, and get back change. The grocery machine handles any denomination. But it’s not an ATM (short for Automatic [bank] Teller Machine).

1·27 days ago

1·27 days agoThe bank isn’t depriving you of your property, you agreed to convert your cash into a legally binding right to access cash in the future

It’s not one or the other. It’s both at the same time. Consumers are deprived of their property as a consequence of that agreement. The bank in case 1 currently says: to get your €19.99 back, either open another bank account or fuck off (in so many words).

From there, it comes down to whether you can sign away your human rights.

1·27 days ago

1·27 days agoThis depends on the country.

In the US: legal tender has different charactoristics depending on whether it is point of sale (PoS) or debt. W.r.t PoS, legal tender ensures the seller can accept it if they want, but have the option. W.r.t debts, legal tender entitles debtors to be able to use it for payment.

In Belgium: there is no distinction between PoS and debts. It’s as CanadaPlus says… Legal tender must be accepted either way. But there are some exceptions: if the seller and buyer are not in the same physical place at the same time, there is no obligation to accept cash. Sellers/creditors can also reject banknotes that are disproportionate to the transaction amount. The bizarre thing about Belgium is there are various circumstances where a debtor only has cash but a creditor can refuse it, e.g. if they have no physical presence. In practice it’s even worse because some business simply break the law by refusing cash, and it’s not enforced.

1·27 days ago

1·27 days agoIndeed, a banker’s draft almost always involves a fee. Though it’s possible that some high value accounts in places like the US would come with some perks like a few gratis banker’s drafts per year. Certainly it’s not the norm anywhere that I am aware of.

And from there, cashing the banker’s draft is a problem. @[email protected] is apparently thinking in terms of the U.S. case where there are (predatory) high-fee “checks cashed” shops all over, where at least you can get a check cashed. I think a European with a cheque is on shaky territory as it is – unlikely to get a cheque of any kind, and also unlikely to deposit one, and in if a European has no bank account it’s likely impossible for them to spend a cheque.

1·27 days ago

1·27 days agoThe premise of the question is when the bank refuses you access to your money, which manifests in a number of circumstances. Receiving a check from the bank is useful only in scenario 1, and only possible in parts of the world that still have checks.

4·27 days ago

4·27 days agoIndeed, and it’s useful to be aware of that… things like pinger numbers. But I certainly would not cut the bank any slack for their oppressive mandate that excludes people without a mobile phone.

I’m a little surprised¹ but not really bothered.

In fact the inconsistency is important in some cases. Most libraries block me from using wi-fi because they force SMS verfication (thus excluding people who do not carry a subscribed phone – thus excluding those who need wifi the most). In cases where SMS is not a barrier, the captive portals are typically broken on my devices. But there are some exceptional branches which do not impose that garbage and they serve as my refuge for access. So I am grateful for the inconsistency.

¹ It’s surprising because the info system is the same for the whole network as it would be too costly to develop separate copies of the overhead. There is only one French membership card that works across the board. So it means that they had to design an info system that could cater for the wishes of each commune. The differences seem to have side-effects. E.g. I don’t think you can return something to a different branch than you picked it up from.