I asked my butler and he said his personal chef didn’t have any compaints

Weird they never mention the quality of jobs.

The peak thrust of $6 trillion worth of COVID-related stimulus for consumers and businesses flowed through in 2021. As those programs ended, the “excess savings” that built up while people were stuck at home receiving stimulus checks dried up and were basically gone by the end of 2023.

-

Six trillion didn’t all go to the working class, PPP loan fraud and all.

-

For you to save you must have money remaining after consumption. Most low income people spend what they have on essentials or if it’s still not enough go into debt. So, the tiny stimulus most people recieved isn’t enough to cover anything.

So, if Americans are comparing the economy now to one from three years ago that featured the government raining down helicopter money, then yeah, it’s a little tougher.

More like the capitalists were so scared of a revolt that they gave a few breadcrumbs to the poor.

the “excess savings” that built up while people were stuck at home

I was able to save so much money because the government also paused all my expenses like rent and food and car loan and healthcare and etc. Oh wait, they didn’t and most Americans were living paycheck to paycheck before then and paycheck to paycheck after then???

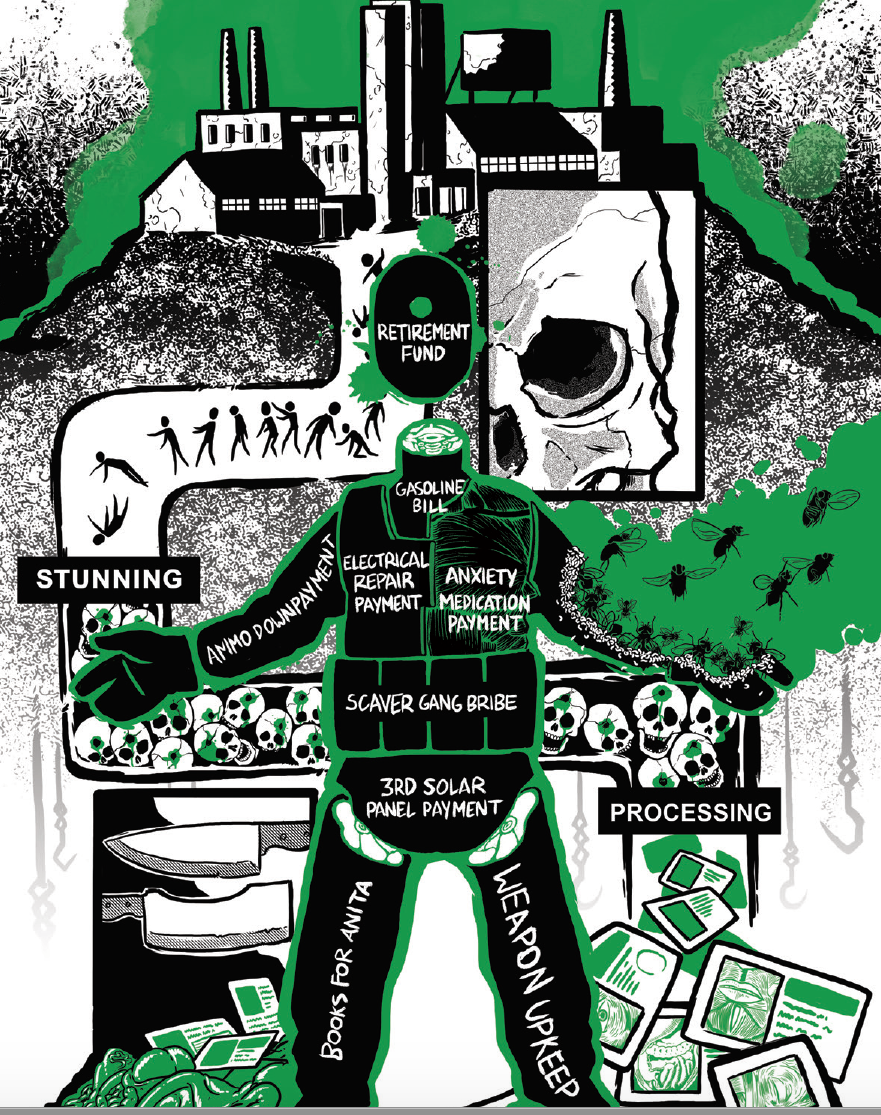

Only reply you’ll ever need to a “Biden created this many jobs” person is “yeah, I have three of them and can’t pay rent”

-

Is the

emoji new? I have a feeling it’s about to get a lot of mileage, especially with bozos writing shit like this

emoji new? I have a feeling it’s about to get a lot of mileage, especially with bozos writing shit like thisman that’s crazy face the

please

pleaseMost in-touch liberal economist

Socialism is when you have 2 pigs but then Mao uses communist wizardry to turn your pigs into iron and you can’t eat pig iron so you have to long march the ho chi Minh trail to the bread line but Stalin already sold the bread to buy cowboy movies

I was about to post this. It’s actually the most serious look I’ve seen at the question of how the economy can objectively suck for most people while all the numbers look good.

ABSTRACT

The wafer-thin poll margins separating President Joe Biden and Donald Trump have surprised and baffled many analysts. This paper attempts no analysis of the election itself. It focuses instead on a clinical assessment of its macroeconomic context. Building on previous work, this paper looks first at inflation’s overall effect on real wages and salaries. It then considers claims advanced by Autor, Dube and McGrew (2023) and others about wages of the lowest paid workers. Real wages for most American workers have declined substantially under inflation. We observe no sign of a radical transformation of the U.S. labor market in favor of the lowest-paid workers. The (modest) increase in real hourly wages of the bottom 10% of U.S. workers during 2021-2023 owed little to any policy change or declining monopsony power: It was a unique case of wages rising to subsistence levels as COVID exponentially multiplied risks of working at what had previously been relatively safe jobs at the bottom of the wage distribution. The paper then analyzes inflation’s persistence in the face of substantial increases in interest rates.

We document the wealth gains made by the richest 10% of U.S. households during 2020-2023. These wealth gains, which have no peacetime precedents, enabled the richest American households to step up consumption, even when their real incomes were falling. Empirically plausible estimations of the wealth effect on the consumption of the super-rich show that the wealth effect can account for all of the increase in aggregate consumption spending above its longer-term trend during 2021Q1-2023Q4. Importantly, the lopsided inequality in wealth makes controlling top heavy consumption spending by raising interest rates much harder for the Federal Reserve, without interest rate increases that would bring the rest of the economy to its knees much earlier. We also show that the persistence of inflation in several key service sectors is heavily influenced by captive regulators – a condition that higher interest rates cannot remedy.

Stocks keep hitting record’s? And who owns these stocks?

The growth was solid and stocks kept hitting record heights in 2008 as well. I’ll remind you that that fiasco only blew up after the banks for a piece of the action.

The wall’s too dignified for this one, chuck him down the pit.

Mmm, and how does the interest rate for a mortgage compare to a decade ago?

This betrays the game and its hilarious. Yeah, the economy is doing fine. That isn’t a measurement of how well people are doing. Just corporations.

It’s hilarious to listen to people on msnbc exasperated asking g how they’re supposed to get it through these dummies thick skulls that the economy is great.

If 60% of people say they think we’re in a recession but all the data says the economy is doing great maybe that data is bullshit and doesn’t represent reality.

Although it is kinda damning that the objective questions like “is the stock market at a record high or low” is literally 48% to 49%, maybe shouldn’t put too much weight o to the other opinions of the 49% of people that say it’s at an all time low.

have you seen what rental incomes are looking like? How can you see that as half empty?

have you seen what rental incomes are looking like? How can you see that as half empty?more like

Some Americans live in a parallel economy where everything is great. They are the tiny minority who own everything. They want the great majority of us–who pay tribute to and serve them–to just chill out and accept this situation as natural, inevitable, and good for us, actually.