- cross-posted to:

- [email protected]

- cross-posted to:

- [email protected]

Claire*, 42, was always told: “Follow your dreams and the money will follow.” So that’s what she did. At 24, she opened a retail store with a friend in downtown Ottawa, Canada. She’d managed to save enough from a part-time government job during university to start the business without taking out a loan.

For many years, the store did well – they even opened a second location. Claire started to feel financially secure. “A few years ago I was like, wow, I actually might be able to do this until I retire,” she told me. “I’ll never be rich, but I have a really wonderful work-life balance and I’ll have enough.”

But in midlife, she can’t afford to buy a house, and she’s increasingly worried about what retirement would look like, or if it would even be possible. “Was I foolish to think this could work?” she now wonders.

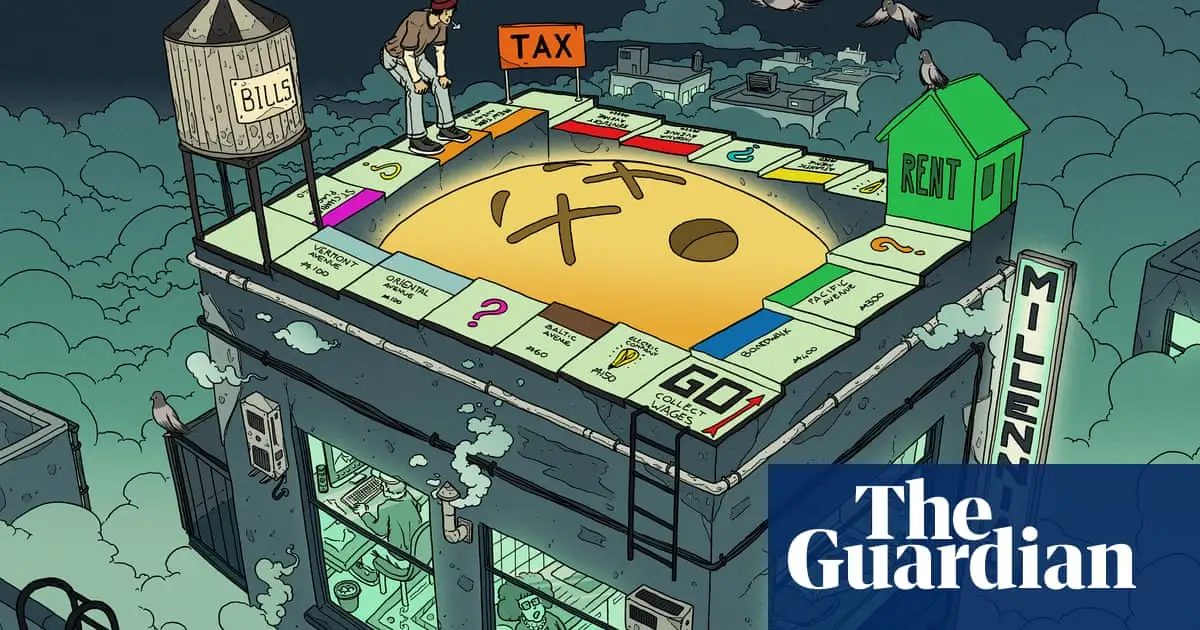

She’s one of many millennials who, in their 40s, are panicking about the realities of midlife: financial precarity, housing insecurity, job instability and difficulty saving for the future. It’s a different kind of midlife crisis – less impulsive sports car purchase and more “will I ever retire?” In fact, a new survey of 1,000 millennials showed that 81% feel they can’t afford to have a midlife crisis. Our generation is the first to be downwardly mobile, at least in the US, and do less well than our parents financially. What will the next 40 years will look like?

I’m a late gen-Xer (born in '80, so I’m more of a “Xennial”). I have a stable job, pension, matching 401k, no kids, no debt (paid off my car and student loans), make 6 figures, and I am STILL convinced that I will never be able to retire. I feel horrible for all those who are in a worse financial situation than me, but we are all really fucked in the next 20 years.

If this is your reality, there’s more wrong with your expectations than your situation.

Social Security is set to run out in the 2030s, and I fully expect the stock market to crash, effectively wiping out my 401k. As others have mentioned, resources like water will start to become scarce, inciting instability.

SSI isn’t set to run out. It will have to be reduced if they don’t take the income cap off of it, however.

But all the other things you said will happen.

that’s as realistic as single payer healthcare; or universal basic income; or sensible gun control legislation; or abolishing the electoral college, they all have super majority support of everyone in this country but there’s too much monied political interest against ever allowing it happen.

Exactly. SS is too popular. There will be some sort of reform/funding, but congress will wait to the least minute to fix a problem. See any sort of continuing resolution government funding bill or the last time SS had problems back in the 80s. The '83 reform only occurred a mere months prior to insolvency. The fact that SS is still years/decades from major problems means it’s someone else’s problem to our elected representatives.

The one thing you can count on conservatives paying attention to is messing with their money.

What happens might not be pretty, but if they try to day “fuck it, guess we are ending the program” there will be hell to pay.

Nah. They’ll be happy that minorities are hurt too.

With enough propaganda anything is possible.

It will probably happen once the cut triggers. You are going to immediately see a lot of angry voters.

Considering how one party is hellbent on getting rid of social security and the other party just shrugs and let’s them get what they want; id expect the shrugging party to be left holding to bag and suffer the political consequences once the cut hits with nothing happening

Correct. IIRC there’s an auto mechanism that will cut all benefits by 23% or something. So you’re mom/dad getting $2,000 a month would now only get about $1,500.

If you think the stock market crashing wipes your 401k to 0 and that’s realistic you need to get your head checked.

In 2020 it only dropped 20% and bounced back within 3 years.

Where do you chicken littles come from? Lol

You only lose money if you sell. Those who were able to stay the course after '08 made it all back and then some.

The risk is a huge crash right before you retire, or you have to pull from your 401k to fund living expenses.

I think the fear is it stays crashed. Like a new paradigm takes over that is hard to plan for

Well that’s a silly fear.

Invest in water you say…

That’s very pessimistic.

Not for the entire southwestern United States. There’s 5 major cities off the top of my head getting ready to face a zero day. If you don’t think the stock market is going to react when that happens…

What’s a “zero day” in this context?

Zero day is the day a city runs out of water and must literally truck it in.

Gotcha, thank you!

I call it realistic. If you think everything is going to work out, you’re delusional, man. But I hope you prove me wrong some day, I really do.

Yeah, I’m not going to live my life like that.

i want to live like you; what evidence to you use to shore up this viewpoint?

deleted by creator

Jumping in here with a couple cents. Background: Old millennial, paid off home, pension, 401K, 6 figs. I’ll be able to retire. My viewpoint: Automation and AI will accelerate. “Safe” jobs will be gone. In fact most jobs will be gone by 2029 (my guess). Goal: keep working and investing until I lose my job.

Hard times will hit because government is slow and wealthy people won’t care until it affects them. Once jobs are cut, profits for many businesses will fall because no one will be buying anything with the money they aren’t making. As big companies begin to fail, stocks will have already begun dropping. Wealthy will go after government and government will have to do something. Only good option to keep things running: Universal Basic Income. Question is where does the money come from? Answer: AI/robots will be taxed and taxed almost 100% more than a human. Why? They won’t care.

This leads us into humans have free-time to do whatever they like. Some can work where AI/robots fail for whatever reason, some can create new things using all the new tools. Businesses will still try and make the best products so the wealthy can still feel better with all the money that really won’t matter as much anymore. They’ll enjoy some exclusive things but it will likely be just locations and not technology.

TL;DR: Hell at first, then modern day renaissance.

That’s, a remarkably rosy set of predictions.

I hope you are right, and big picture, I think things might shake out that way eventually.

But I am not as optimistic as you on several points.

I don’t think LLM AI will do as much as you claim as fast as you imagine.

I don’t think the owner class will put enough pressure on the politicians to generate that level of systemic change. They will muddle through with a thousand band aids stuck together.

Which will lead to an increasingly dystopic hellscape in which young people increasingly persue careers as scam artists, wanna be celebrities, and outright criminals because those are the only paths to a comfortable life.

But so hope to be wrong. Good luck to us all.

star trek style. lol

deleted by creator

No evidence. I just choose to live with a positive world view and not like every day is doom. I face problems head-on when they appear and I don’t collect sorrows in advance. But you do you. I know my approach is hard for most people.

facing problems “head-on” doesn’t mean you can’t anticipate problems that are likely to arise. in fact, deliberately ignoring clear indications of future problems is dumb. this approach is literally why climate change has become a problem over the last several decades.

lastly, accusing people of “collecting sorrows” for calling out these likely future problems doesn’t mean they’re collecting sorrows, it’s just you trying to validate your “positivity-only” approach

do you identify with any of the people in the article? if you do; how so?

Weird flex, but ok

He’s lying.

I’m almost exactly same as you and you’re full of shit.

If you’re honestly making 100k with no debt and one mortgage around 300k you can save 2k a month if your wife makes a decent wage.

Who said they have a wife?