No source?

And this why democracy won’t work. How can people votw in their best interests when they don’t know how basic taxes work

Tell me you don’t know how income taxes work without telling me you don’t know how income taxes work.

My question is who does their taxes then?

A lot of people don’t know anything about taxes and have their tax return done by an accountant, even if their situation is extremely simple (works one job, no taxable investments or capital gains, no investment properties, no foreign taxes paid).

Even if they did go through the trouble to do their own taxes, the IRS specifically instructs taxpayers to not calculate it themselves, but rather to use a “tax table” to lookup their income and next to it is listed their income tax amount.

Shouldn’t it be physically possible to be taxed so much that your income lowers compared to what it was previously?

Like you would have to have a 20% bump in pay, and an increase in taxes that’s like 25-50% or something insane. Of course if you cherry pick data, and pick a high ceiling, and then just barely pass a threshold you can probably make it appear, but that would be a pretty well defined statistical anomaly. And, not very much money.

edit: and this is assuming that taxes literally just don’t work the way that they do, this is WITH broken tax logic.

of course, the idea of a progressive income tax is that at a certain point, it becomes untenable to hold so much money. But unless taxes are literally 100% it’s hard to make the argument that you’re “losing” money.

If the tax bracket for no taxes is $10k, you don’t get taxed if make under that.

If the tax bracket for 5% is $10-20k, and you made $15k, the first $10k is not taxed, but the $5k is taxed at %5.

So you would never make $0 after taxes, even if you made it into the hypothetical 100% tax bracket.

yeah, with how tax brackets actually work, this should be physically impossible, i’m just pointing out that even if it didn’t it would STILL have to be a pretty substantial increase in tax, that you could easily calculate.

Ah yeah. It would take a lot. Even at 90% $100m from a billion is still way more than most of us.

How dumb do you have to be? By the time you make that much money you should, in theory, know the answer definitively or have a guy.

This belief is held by many older folks due to propoganda, and it is passed down to their children when their parents teach them about taxes. Since almost all younger folks use automated tax services, if they aren’t doing the math themselves, the fact that this isn’t true isn’t going to be discovered. I was taught the incorrect way when I was a kid, but noticed that it was wrong the first time I had to do my own taxes. But when I told my parents the way it actually worked, they didn’t believe me until I showed them the .gov site that breaks it down. I grew up in a small, blue collar town, and every single person I talked to about taxes parroted the same incorrect system.

For someone outside the American tax system, can anyone put the difference in approximate numbers?

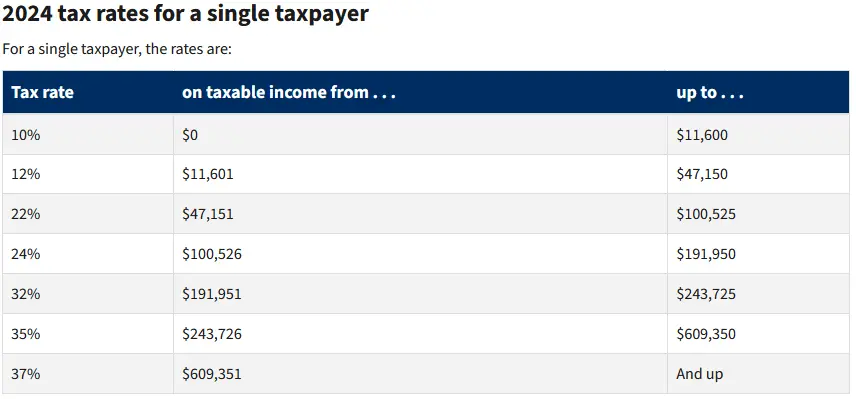

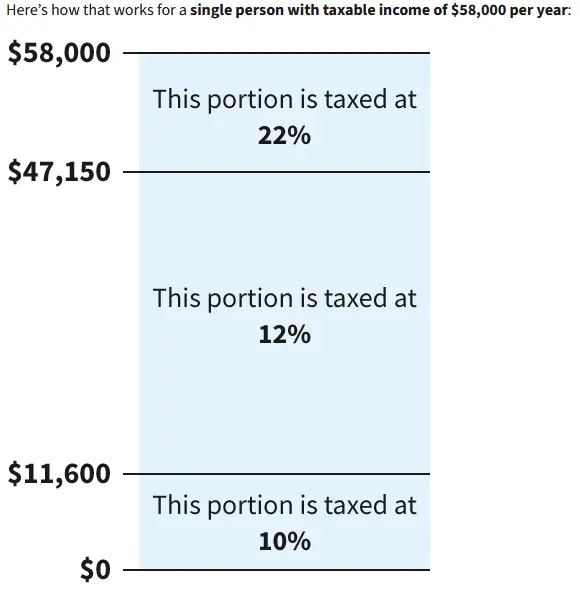

This all boils down to a common misconception about ‘tax brackets’.

To simplify, pretend there’s a 28% tax bracket up to 100,000 dollars, and a 33% tax bracket when you hit 100k. The first 100k is always taxed at 28%, no matter what you make, and it’s only the incremental amount that gets taxed heavier. So here in this example, that would mean tax burden would be 28,000.33 instead of 28,000.28. These are not the exact brackets or percentages, but it’s at least showing the right magnitude of increase versus total amount.

However, many people are “afraid” of bumping a higher tax bracket. They think the tax bill would go from 28,000.28 to 33,000.33. That the tax bracket bumps up all your liability. I remember growing up people saying “I have to watch out and not hit the bigger tax bracket, if I’m close then I need a big raise to make it worth it, or else the raise is going to cost me more than it would make me”. This a big driver of antipathy toward democrat tax policies, a belief that mild success will punish them, despite it only increasing on the incremental amount.

A lot of US benefits have “benefit cliffs” where making $1 more substantially reduces or even completely disqualifies a person from programs like SNAP (food stamps) or childcare subsidies or Medicaid. https://www.ncsl.org/human-services/introduction-to-benefits-cliffs-and-public-assistance-programs

It’s not surprising people whose families are directly affected by, or who know people affected by, benefit cliffs think the lawmakers set up taxes the same way.

True, though if we are talking about tax bracket going over 30 percent, that would be at nearly 200k, so well above those thresholds too. Of course the numbers aren’t 28 and 33, but that is the closest threshold to the example.

OK, so it is similar to our system. And would probably in the range of cents or a few dollars then.

To be more specific the first 100,000 isn’t taxed at 28%. The 44 to 100k range would be, but below that will be taxed at lower percentages. The first ~10k you make is taxed at 10%, and then it increases throughout.

The first ~10k you make is taxed at 10%

In the USA, technically the first $15,000 (if single) or $30,000 (if married and filing jointly) at least is taxed at 0% due to the standard deduction. If you earn less than that, you can tell your employer that you don’t want any tax to be withheld.

If getting specific, there’s no 28 percent or 33 percent bracket, so these are all examples rather than real figures. I did make a comment using real numbers, same general magnitude but just more specific about the brackets.

Your local tax system probably works the same.

In exact numbers, 5 cents.

That one dollar in the 33% bracket has .33 in taxes instead of .28. So their obligation goes up .05 per every dollar in the 33% tax bracket.

This is the problem. My partner doesn’t want to work OT because he thinks it will cost him more in taxes. I explain why that’s not exactly true, but I can tell he’s not interested. Financial Literacy in the US is abysmal.

This is not a US specific issue, tbh. I’ve heard this weird belief repeated by all sorts of people.

You’re absolutely right. I cant speak for anyone else, as I don’t live there but I highly doubt the US is an exception.

Rather than being mad at each other, I want to make sure we hold the right people accountable! Governments, corporations, billionaires etc.

It’s a form of oppression.

I’ve heard it in Australia too, which has the same tax bracket system as the USA. I think the fact that this stuff isn’t taught in school is a major issue.

“you can’t make less money by making more money”

Unless you’re poor enough to be on welfare. The Welfare Cliff is awful.

This can also apply to student loans when one person makes a lot more than the other.

Your partner is a moron who doesn’t understand relatively simple math.

Nah. He’s not an idiot. But he is impatient. He doesn’t handle paperwork or anything involving patience well. (ADHD)

I also think taxes in the US are intentionally over complicated and confusing. I don’t struggle with things like that but I can empathize with people who do.

have you considered asking him why he even thinks that in the first place? You’ve literally put him into a spot where he’s too stupid to even care about whether or not that response is logical or makes sense.

If he just doesn’t want to work overtime that’s fine, a lot of people don’t, why would he justify it with stupid tax logic that he evidently must know is stupid? Seems like cope to me.

You cannot simultaneously “be smart” and then “be stupid” you are either stupid about something, or not. It’s one of the two. I’m sure he’s a pretty generally smart guy, most people are, but either it’s an excuse he uses because he doesnt want to work overtime, or he’s literally uneducated (and therefore stupid) about taxes, and chooses not to be educated about it, even though it would be financially beneficial to him, because that’s literally how money works. (which would also make him pretty objectively stupid in that case) again, he may not care at all, but then why wouldn’t he just be upfront about not caring?

Strictly speaking the taxes in the US are not that complicated, but the credits, deductions and what not are. Still Tomato Tomato.

There’s not enough information provided to reach this conclusion.

There is very much enough information given to reach that conclusion.

No, there is not. There are many tax credits one is no longer eligible for after a certain threshold. There are various programs one is no longer eligible for after a certain threshold.

Most of the likely credits tend to phase out gracefully. So it’s true that we can’t be certain, based on my experience of when people are afraid of making too much money, it’s almost always because they think a higher tax bracket applies flatly across their income not due to nuanced understanding of tax credit and welfare benefits.

This is true for many people I’ve talked to, but he does understand, on a basic level, how the brackets work. When it comes to the calculation parts, I think he gets frustrated with all the rules.

But it’s okay! I’m good at stuff like that and he can build pretty much anything. We all have our strengths. :)

Oddly enough it kinda does. OT can make you pay out more taxes on that one check since withholdings are calculated by check. Basically the government/payroll system thinks you’re going to be making that every week so more taxes will be taken out.

In reality this only effects the size of your tax bill or return at the end of the year.

Exactly, and it also depends on what withholding you have requested.

That’s what people see and exactly why they think they got kicked up a whole tax bracket.

The whole notion of “kicked up a tax bracket” is also a misleading thing. Only a piece of your income goes into the “new bracket”, all pay under the new bracket is taxed as they would have been used to.

Run, if it’s not too late.

We all have our weaknesses and faults. No need to dismiss every relationship due to imperfections.

Nah. He’s not a bad person or a dummy. He just gets frustrated by bureaucracy and doesn’t have the patience I have.

By design

No, they teach you this in high school. These people are just dumbasses

Yeah, I definitely didn’t leave this in school. I know about it from reading articles on tax brackets. _(‘’)/

Yes, everyone’s education is the same as yours.

It boggles my mind how many people who have had to pay taxes for decades even, don’t understand how tax brackets work.

The only time you’ll get screwed on making more is if you were getting some sort of socialized assistance and you make a dollar over the cut off for aid.

Yeah, the Welfare Cliff is the only place where this happens and it’s unconscionable.

It is kind of by design to keep people from trying to get ahead at all

And to keep the private tax filing agencies afloat

And they’ll also refuse to believe you when you try to explain it to them

try telling this to people who think government agencies pay taxes

Sam is the GOAT

That dude would have been hilarious if he wasn’t really so delusional. Not Sam, he was great. The dude that was convinced that government agencies get tax breaks.

What? Is this the onion?

One of those rage bait YouTube channels had a young person who made that claim in a debate. Pictured is Sam Seder who was the debate opponent. He made this face at the camera.

That was an entertaining 90 minutes of YouTube! And I definitely saw that face

The channel is Jubilee. The format is that 1 fairly prominent political activist debates 20 people with an opposing position for a few claims the 1 has given beforehand. The 20 swap out who gets to debate at any particular time by voting them out.

I’ll admit it is ragebaity sometimes, but I also find it educational and entertaining. There’s typically about two among the 20 that have gone off the deep end, but everyone else is respectful and appreciative of the opportunity to engage the other side. Also, it does have good fact-checking so the crazies are at least recognized properly.

This is the video the image came from.

They give Nazis a platform. I don’t watch it because of that. Plus I try to avoid rage bait content as much as I can.

you probably stop paying ur isp then

Thanks

Poor Sam

I used to be a supervisor at a psych hospital and had to regularly explain this to staff who were refusing overtime. They wanted to do it, sometimes desperately so because they needed the money, but they were utterly convinced that once they crossed 40 or 45k or whatever they would be taxed higher and make it all pointless. I felt like some just didn’t want to do ot, which was fine, but some legit keep meticulous records of their earnings to ensure they wouldn’t go over the line. I swore to them it didn’t work this way but they never believed me

every day, my theory that people are just willfully retarded gets proven more and more correct. Even with the tools at the disposal of the modern internet savvy person, nobody tries ANYTHING to verify ANYTHING.

It’s actually so fucking depressing and i think humanity is joever at this point. I’m not sure how you recover from this point effectively.

Seen the same bullshit when I worked retail. Nothing will convince them.

It’s easier to trick someone than it is to convince them they’re wrong.

I wonder how different the planet would be if boomers had just been taught, from an early age, that it’s OK to be wrong.

I remember my mom saying something like “don’t believe what you see on tv and only half of what you read.” Yet here we are.

My mom told me “these white people will never see you as an American”

Now she’s blaming democrats for “Migrant crisis”

🤦♂️

Yeah, I remember my parents teaching me a whole lot of shit that Fox News would call “woke” today. I’m just thankful that I grew up when I did, because if it were now I’d probably have died of measles.

Should print out a poster infographic explaining progressive taxation and put it up on the wall in the break room

Would have to be mandated by workplace regulations, no company is going to voluntarily educate their employees that more money has no downside.

I’ll also say this doesn’t help, it strangely avoids the actual numbers. It should state explicitly that his total taxes would be $1,600+$4,266+$2,827=$8692, and not $13200. Needs to include the scenarios specific results and contrasted with what the viewer would have assumed otherwise.

This infographic is kinda bad and would not convince someone who doesn’t know how it works at all

Yeah I am pretty sure they wouldn’t understand this either

But you have to keep it going to highlight how much wealthier people pay (although that’s tougher since their income is not “income”). Maybe throw in a few examples of the wealthiest Americans and wha recent age they pay, to not only clarify it, but retarget their anger where it belongs

We covered how taxes are calculated at school, it isn’t very complicated. Yet SO MANY people insist they end up getting paid more it made me question myself for a while.

Although sometimes the removal of certain benefits does mean people can be worse off for £1 extra. Which if anything is just a sign that the benefits were poorly thought out and should taper off instead of being a hard limit.

There is probably sticker shock involved. Someone who gets a raise will see a new amount of taxes witheld and may be upset. It could even be they didn’t know what the amount taken out before taxes was.

The only way that’s a problem is if you’re on certain government benefits, if you make just a little bit too much there’s a hard cutoff for many benefits so you may end up losing more than you made in OT. But if your staff is facing this dilemma, they need to be paid more.

Pay them more? So they can lose their benefits? Are you crazy?

I’m kidding, of course. I know that what you mean is, “pay them so that they can afford to live without requiring benefits.”

You get into some of the poorer places in the country though, that truly would be nearly impossible for most businesses. There are some places in West Virginia that would immediately have no access to gasoline, groceries, etc.

It is crazy to think that Bobby McBusinessman gets to ride around in a giant RV all summer because the government pays his employees. They don’t see it that way though, as they collect their HUD payments and accept food stamps while all of their employees receive food stamps and medical benefits.

All while the rest of the community lives on nothing and experiences very little joy in this life.

What do I know though? I’m just a pissed off hillbilly who helped make someone who isn’t me very rich.

Short of doing a demo with rolls of change or MnMs or something, asking people to conceptualize math that is not just simple addition is often asking too much. Especially when people’s financial literacy is learned at home from people who retired in 1996.

Well look where we are, trump loves the uneducated, they got his thieving rapist ass elected.

If you ever wanted proof that a population that doesn’t understand math allows the billionaires to take advantage of them here it is. This is why education systems are under attack, because if you understood how taxes work you’d more likely support higher tax rates for the rich.

Probably the lead poisoning have something to do with it.

Some houses still have lead, to this day.

I know because my city recently passed a law requiring landlords to inspect rentals for lead paint, because a lot of kids are still getting lead poisoning.

(Its Philly btw)

I think this is at least partially the result of intentional propaganda. It benefits the elite greatly if a lot of Americans are screaming against higher top tax rates due to this faulty logic. There are also a lot of anecdotes of people not accepting higher paying job offers or promotions within their company, which also benefits the business owners.

https://youtube.com/shorts/-621rVJvUdY

Mr. “Population collapse is the biggest threat to the world.”

Maybe it’s just the biggest threat to capitalism and your ROI. Why do you think he’s supporting the make everyone dumber party?

To be clear for those unaware, you pay the lower bracket rates for the amounts earned in that bracket and the higher bracket rates for the amounts earned above that bracket.

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

This is actually not true as it doesn’t take into account the standard deductionI upvoted because you chose to strike thru rather than delete. Big props for that

Agreed, I love people that own their mistakes.

I try to be accurate. Hence why the comment in the first place.

Read the chart, it says taxable income.

Deductions and other tax games may lower you’re taxable income, but the progressive tax brackets apply this way to all taxable income.

It does not take into account a lot of things, namely the many many deductions for qualifying individuals.

Not all people take the standard deduction, this is true before all deductions and similar economic stimuli.

I’m more concerned about the third of dems who don’t understand this.

it’s in the shitpost community and there’s no sources cited

I feel that “outgroup dumb” is shitposting but it’s from a real poll.

https://today.yougov.com/politics/articles/5057-understanding-how-marginal-taxes-work-its-all-part

My tired brain read your comment as “shitpost economy” and somehow that still made sense to me.

Oh