- cross-posted to:

- [email protected]

- cross-posted to:

- [email protected]

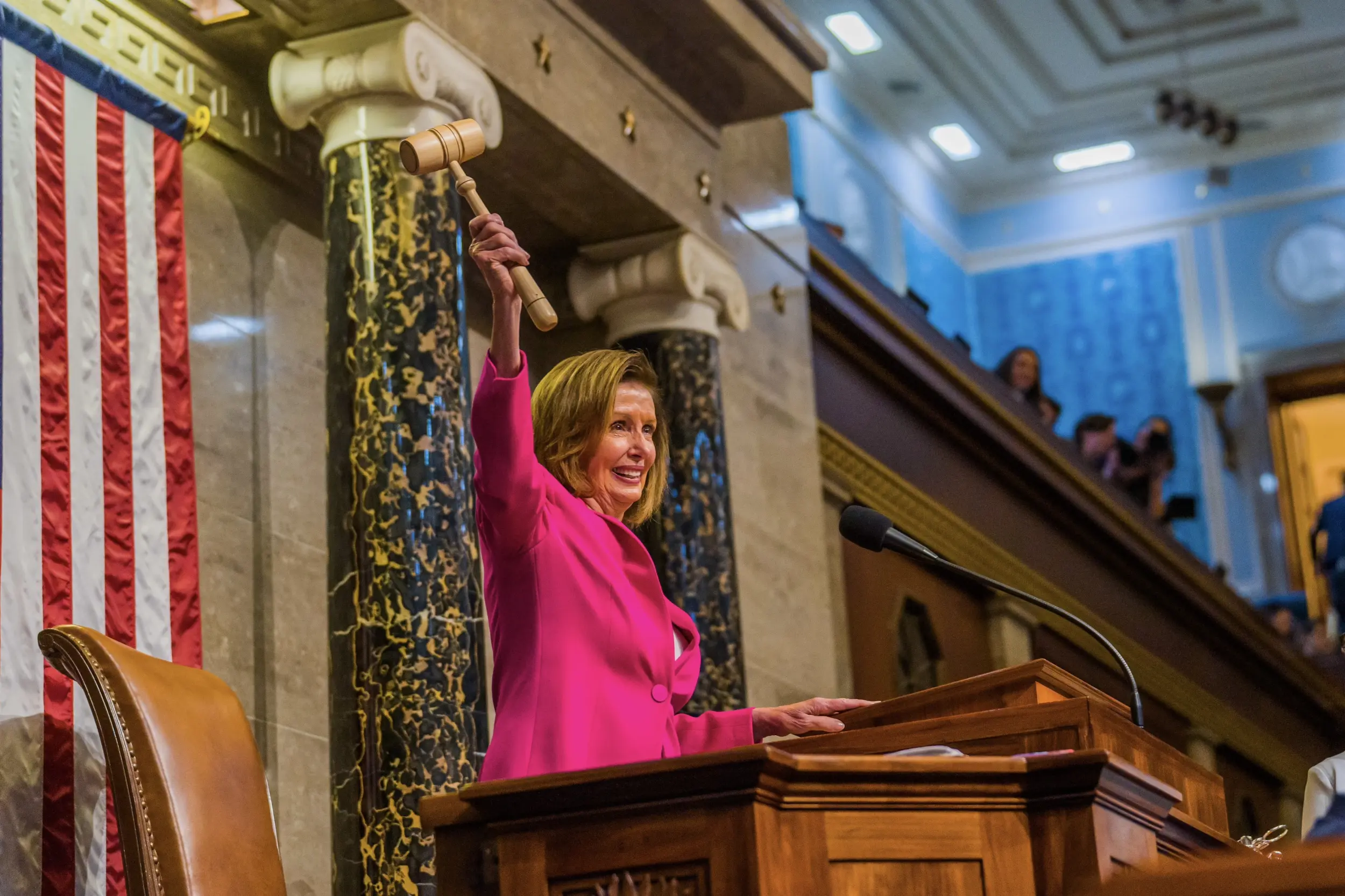

According to the alternative data platform Quiver Quantitative, replicating Nancy Pelosi’s stock trades would have yielded returns exceeding 720% since May 2014.

It really helps if you are allowed to do insider trading.

We can all do insider trading. They have to publish their maneuvers publicly, just copy them. The Pelosi index is a winner.

Not really, no

They report 45 days after, and buying their stocks at that point is just even more stupid… A completely hyper capitalistic idiotic system that is going to be laughed at in history books as the moronic tragic catastrophe it is

A person like that doesn’t handle her own portfolio, and their trades are public. Nothing prevented you from trading the exact same stonks they did.

Politicians shouldn’t trade because they can still manipulate the bigger picture, favor corporations and move the economy a certain way. Not because they are sitting on Robin Hood at night making money.

their trades are public

Up to 45 days after the trade is made.

While not technically insider trading because they don’t work for the companies they’re trading, they definitely have access to privileged macro economic knowledge

That they can’t really use because they don’tanage their portfolios. What they can do is make policy that benefits them instead of the other way around, that’s why they shouldn’t be allowed to trade stocks.

Now what happens is you say they are inside trading, they say “impossible we don’t manage our stocks” and everyone goes in circle. Stop attacking the part where they are gaming it by managing stocks, and instead focus on them not being allowed to trade in general, for a multitude of reasons.

They a billion percent are doing their own trades if they want. Do you remember Covid? Do you remember how many of our politicians made a mint because they had the inside track?

Why are you assuming they don’t manage their portfolios?

Because Paul Pelosi is a trader.

And Pelosi’s trades are all tech which makes perfect sense because she’s the rep from San Fran. Most of them are long big tech which would have crushed over the past decade or two.

It’s statistically improbable that she would have a 700% return over 10 years. 700% and it’s all on the up and up? Come on …

That’s why I said she is definitely using her position to make money.

What i’ve said many times now is she does it through policy, not through robin hood. If everyone would just wake up and stop asking for laws to keep them off robin hood, and start asking for laws to keep them out of the money entirely so they have no incentives to help corporations for personal gain (through their portfolio managers).

So, like every other political system since ancient times. So what you are proposing is the common sense that every single other country and system ever existed had. Bold

Quick math says that’s about a 19-20% return annually for the 10yrs since 2014.

The average APY of the S&P 500 over the same time period was about 11-12%.

So definitely way outperforming the market, though maybe achievable with one or two good picks on individual stock?

Definitely not a good look regardless.

deleted by creator

It’s no real secret. Her husband has been buying tech stock LEAPS this whole time. Her portfolio took a huge hit during the tech sector downturn a few years back. Paul doubled down on the tech stocks which have all shot way back up. He put a bunch of money on Nvidia during the GPU shortage well before all this bullshit AI run. Nvidia is up something stupid like 800% since then.

If anything I’d bet it’s because she’s connected in Silicon Valley. Nancy has the same info everyone in Congress would. But since her district is in the bay area she gets to rub elbows with the right people.

I actually think a 20% return is modest. She literally has her finger on the pulse of the economy. She should have done better.

Not saying I condone it but if you’re going to crime and get away with it, as least go big.

Professional portfolio managers, who do this for a living, with teams of intelligent and educated people working for them, struggle to consistently outperform the market in any meaningful sense.

20% is not modest in any way.

Maybe she still thinks she’s being sneaky

if you’re willing it risk it and use leverage (borrow money to multiply your return, but also multiplies the down sides) sure she could’ve aimed for the moon. but theres no need to be risky when you’re her age and already rich and have a crystal ball.

Fuck Pelosi. She’s a piece of shit. Just another symptom of this collapsing empire. FYI I am a democratic socialist.

I know people who have worked in corporate acquisitions and there are a ton of controls in place to limit information access and prevent the mere appearance of privelged information being used for personal gain. Likewise in other industries like utilities there are pretty complex regulations to prevent companies from getting even a few cents per kilowatt hour advantage, etc. and all this shit has multimillion dollar fines attached.

Congress could definitely adopt a rule that bans trading stocks for anyone who receives classified or nonpublic industry-specific information as part of security briefings or their committee assignments. Or hell, just limit congresspeople to index funds or generic portfolios managed by external fiduciaries, while in office.

It seems that if both Gaetz/Cruz types and AOC agree on this, they could get it done, but the establishment politicians don’t want to because they view it as a perk of the job.

deleted by creator

Yeah, the rules will be regarding the information benefiting outside investors instead of Congress.

Doubt

Hey. Shut yer mouth.

Yes, continue focusing on her and never talk about the Republicans that beat her every year.

just looking at the website, you can tell the target audience is specifically the 1% who want republicans to win. it’ll be the same shit with pretty much anything with “business” or “financial” or “economy” in the name of the site

so yea, they will NEVER talk about the insider trading, cheating, fraud, etc. done by republicans

But even in social media, people have been so focused on her while ignoring that she’s never #1 (heck, in 2022 she got beat by the S&P500) that I can’t help but wonder if there’s some underlying misogyny that explains it…

underlying misogyny

it’s not underlying, it’s blatant, and misogyny is a core part of the GOP platform. yes, republican women are most definitely misogynists

Pretty naive if you think only Republicans are complaining about her trades!

everyone’s absolute top priority for the next three and a half months should be keeping trump out of the white house. complaining about dems doesn’t help to achieve that objective, it hinders it. when trump loses, by all means–criticize all the dems all the time. but at this point, bOtHsIdEs-ing anything is accomplishing nothing but strengthening an R win and weakening D

Please note that my original comment was me pointing out that people complain about a democrat while ignoring all the Republicans that do better than her, so please don’t tell me I’m complaining about the elected Democrats, my only criticism of Democrats was against electors hating on Pelosi instead of their true enemy.

Whataboutism shouldn’t be used by either side. She shouldn’t be doing it.

Why is buying LEAPS of the biggest tech growth stocks in the S&P 500 wrong? That’s literally Paul’s strategy. It isn’t much of a secret.

He’s even lost money plenty of times on individual trades. He sold out of a 25,000 share Nvidia position. That at the time would have been worth around $600k. Had they held that position it would be worth $31M or so now. That’s a huge miss for someone supposedly getting insider info.

Would you care to list them so the conversation can be more complete?

Copying a comment from a couple of weeks ago, the source is the website that made everyone really start paying attention to her by posting an infographic that made it easy to visualize the gains compared to the S&P500 but somehow it’s only Pelosi that people complain about

2021 she’s 6th behind 5 Republicans, 2022 she’s under the S&P500 in 27th place, 2023 she’s in 9th place

https://unusualwhales.com/politics/article/congress-trading-report-2022

https://unusualwhales.com/politics/article/congress-trading-report-2023

Thank you.

Brian Higgins had an unbelievably good 2023.

Casual 238.9% ROI, nothing to see here

She’s not even in the top 5 for Congress, why does she catch all the flack?

I presume it’s because she’s seen in somewhat of a “senior leadership” position.

Johnny Beluga, the esteemed congressman from butt-munch, Iowa might have five times more illicit gains than her, but no one knows who he is, so fewer people would watch the news to hear about him.

Man, someone needs to create an index fund which just follows their moves. If we’re not going to punish obvious corruption we might as well get something out of it.

They don’t have to report their trades until 30 days later, with a slap on the wrist if they violate this incredibly lax requirement. By the time you follow, it may be too late.

If we aren’t going to outlaw them from trading, maybe we should require all disclosures to be same day.

https://www.capitoltrades.com/trades

the data is there

Johnny Beluga

Who? Is this a nickname I don’t recognize?

Its nobody. It’s a fake person to avoid mentioning anyone in particular.

Like referring to “Johnny Punchclock” or “Joe Everyman”

Your mistake was using Butt-munch IA, which is not only real but it’s the county seat of Cornhole Co. Too believable.

She’s the most consistently well off Democrat trader, as well as occasional speaker of the house of representatives, so the right shits on her and so does the left.

TBH I’m not that against her, she helped pass the transparency laws we currently have over traders in congress, and all of “her” trades are due solely to the fact that when she was in college she married a guy who now owns an investment firm. All of his trades belong to her by nature of joint assets. One of her most notorious trades was when VISA attempted to give her husband some amazing stock options before a big vote on regulations on creditors, of which he bought, and then she voted against VISA’s interests for the regulations. Paul still made a profit, though.

yeah she was only the leader of the party for like a quarter century

She’s known as “nance in advance” in trading circles. Some funds follow her investments.

There’s an ETF called NANC that allows you to invest in line with her portfolio. There’s also one called KRUZ that follows Ted Cruz.

https://www.cnbc.com/select/congressional-stock-trading-could-soon-be-tracked/

Looks like NANC is for all Democrat member trades, and KRUZ is for all Republican member trades. If you’re wondering, NANC has +32% standardized pre-tax returns, while KRUZ has +19.1% standardized pre-tax returns.

That’s more just a reflection of the NASDAQ doing better than the DOW over the same period.

Semi unrelated question (also only semi serious): is there a program or script that can follow a person’s trades and make similar trades? Or is she one that, by the time the public knows, it’s already too late to jump on the bandwagon?

By the time the trade is disclosed it’s been like a month and you may be part of the exit liquidity

There is a congressional rule that requires individual stock trades of certain amounts to be publicly disclosed within 45 days. However this is apparently not really enforced right now.

Some bipartisan congresspeople have proposed more restrictive rules and bans on stock trading, but those efforts haven’t gained traction yet.

Unusual Whales Subversive Democratic Trading ETF (NANC)

fucking lol I didn’t know there was an Unusual Whales ETF. Naming it NANC is genius.

Look up Quiver Quantative. They actually track investment portfolios of members of the House and Senate and send out newsletters.

Autopilot. It doesn’t support every brokerage though.

I always wondered this too

etoro is a broker that allows you to “copy trade” popular investors and portfolios, which mimc trades according to how much capital you have invested, though Nancy ain’t gonna be on there

There’s also ETFs such as ARK which are easy to get into, are managed by the likes of Cathie Wood and if they’re doing a good job, only go up

Biggest regret in the last 15 years is not getting into it earlier tbh, if you have even a passing interest in trading, open a mock account (or a real one with some money you don’t mind “losing”) and just have a go - it’s very simple nowadays. Gone are the days where you need to pay $10 to a broker to even make a trade

One of biggest crooks but not the biggest by far. Anyone who isn’t in government and gets that kind of return would have all the financial bureaucracies all up their ass.

I despise that woman. When people say the left is as bad as the current GOP, she is who they’re looking at.

Yes, except she’s not “left”.

Just like most Republicans aren’t the “right”

Conflicts of interest.

she conflict on my interest until i return 700%

I’ve managed 60ish% in 3ish years.

Would be higher but i was invested in Cineworld… that was a sore time

That’s pretty good, and if you can maintain that, you’ll have 400% in 9 years.

700% in a decade is very unlikely, without either insider trading or tremendous luck.

I’m personally at 39% also for about 3 years, and AFAIK that’s slightly better than average.It’s was her husband’s job wasn’t it? Not saying what they did was legitimate, but full time job vs side investment should make a difference.

Wish the FBI would investigate for corruption like they did here: https://www.wikipedia.org/wiki/Abscam

Wasn’t officially codified until 2012.

Thought they were exempt.

I remember something recently along the same line that said they passed a law allowing themselves to benefit from some stock function the general public can not. Not sure what.

I’m surprised everyone focuses on insider trading. To me the much bigger risk is: shouldn’t your decisions affecting the country be unaffected by stocks you own? If you own $10 million of Apple stock for example, how does that affect your vote on an antitrust law? This is a problem even if there’s no inside information.